Trip.com Group’s 2026 travel outlook shows Asia leading global demand, with Japan, China, Thailand, and Türkiye among top destinations. Millennials and Gen Z will drive nearly half of bookings, while entertainment, nature, and cultural travel gain momentum. Interest in alternative destinations, scenic rail and cruise journeys, and sustainable options like EV rentals highlights a shift toward more experiential, eco-conscious travel.

Trip.com

Trip.com20 December 2025

Global Travel Trends for 2026: Where the World Is Headed Next

Trip.com Group has released its latest outlook on global travel trends for 2026, drawing on booking data and traveler behavior to identify the destinations, experiences, and motivations shaping travel worldwide. The findings reflect a travel landscape that is increasingly experience-driven, regionally diverse, and influenced by sustainability, entertainment, and generational preferences.

Global Travel Trends for 2026: Where the World Is Headed Next

Trip.com Group has released its latest outlook on global travel trends for 2026, drawing on booking data and traveler behavior to identify the destinations, experiences, and motivations shaping travel worldwide. The findings reflect a travel landscape that is increasingly experience-driven, regionally diverse, and influenced by sustainability, entertainment, and generational preferences.

Asia Leads as Global Travel Demand Accelerates

Asia continues to dominate global travel interest heading into 2026. Based on Trip.com Group’s forward-looking booking data, Japan is expected to remain one of the world’s most in-demand destinations, consistently ranking among the top outbound choices for travelers across Southeast Asia and Northeast Asia. Major cities such as Tokyo and Osaka are projected to feature prominently on international travel itineraries, driven by a combination of cultural appeal, strong infrastructure, and global entertainment offerings.

Other destinations expected to attract significant visitor volumes next year include China, Thailand, the United Kingdom, and Vietnam, reflecting a balance between long-standing favorites and fast-growing regional markets.

Demographically, Millennials (ages 29–44) are forecast to represent the largest share of travelers in 2026, accounting for nearly half of global bookings. Gen Z travelers are close behind, reinforcing broader public data showing younger generations prioritizing travel experiences over material spending.

China and Türkiye Gain Momentum

China is emerging as one of the fastest-growing travel markets globally. Trip.com Group data indicates that flight bookings to China from Southeast Asia are expected to grow at triple-digit rates year over year in 2026, with travelers from Malaysia, Singapore, and Thailand leading demand.

While gateway cities such as Shanghai, Guangzhou, and Chengdu remain popular, rising interest is also being seen in cities including Beijing, Harbin, Chongqing, Shenzhen, and Xi’an. This trend mirrors broader public tourism data showing travelers increasingly exploring beyond primary hubs in search of more localized and culturally immersive experiences.

A similar pattern is playing out in Europe, where outbound travelers are looking further afield. Asian destinations—particularly China, Japan, Thailand, and Türkiye—are expected to rank among the most popular choices for European tourists next year. UK travelers are projected to become one of China’s top source markets, while Thailand and Türkiye are on track to be the leading long-haul destinations for German travelers.

Entertainment Tourism Drives Travel Decisions

Entertainment-led travel continues to be a powerful driver of demand, especially across Asia. Major theme parks such as Shanghai Disneyland, Hong Kong Disneyland, and Universal Studios Japan are expected to remain top attractions on 2026 travel itineraries.

Fan-focused experiences are also shaping travel patterns. Studio tours linked to global franchises, large-scale exhibitions, and live events—including K-pop concerts and international productions—are drawing travelers willing to plan entire trips around a single experience. Immersive attractions tied to well-known brands and pop culture are increasingly viewed as “must-see” travel moments.

Globally recognized performances and venues—including Broadway shows in New York, major theatrical productions, large-scale entertainment venues in Las Vegas, and water-based shows in Macau—are also expected to see sustained international demand.

Nature, Culture, and Slower Travel Gain Appeal

Alongside entertainment, nature and cultural tourism are gaining momentum. Travelers from Southeast Asia and Germany, in particular, are showing increased interest in outdoor and scenic destinations such as New Zealand and parts of China. Natural landmarks, national parks, and wildlife attractions are becoming central to travel planning, reflecting broader public trends toward wellness, sustainability, and meaningful travel.

In Europe, cultural immersion remains a major draw. Iconic institutions and historic landmarks—including museums, cathedrals, and heritage districts—are expected to rank among the most-visited attractions in 2026.

Another notable shift is growing interest in train and cruise travel. Scenic rail journeys and premium cruise experiences are seeing renewed demand, aligning with global trends toward slower, more experiential forms of travel.

Sustainability and the Rise of Self-Drive Travel

Sustainability is increasingly influencing traveler choices, particularly around transportation. Trip.com Group data shows steady growth in electric vehicle (EV) rentals following the introduction of carbon labeling in 2025, with strong uptake in markets such as Norway, Australia, and Japan.

This reflects a broader rise in self-drive travel, especially among Asian travelers exploring Europe and Australia. EV rentals are being favored for their environmental benefits, flexibility, and comfort, underscoring a shift toward more personalized and eco-conscious travel experiences.

Looking Back: Who Traveled the Most in 2025

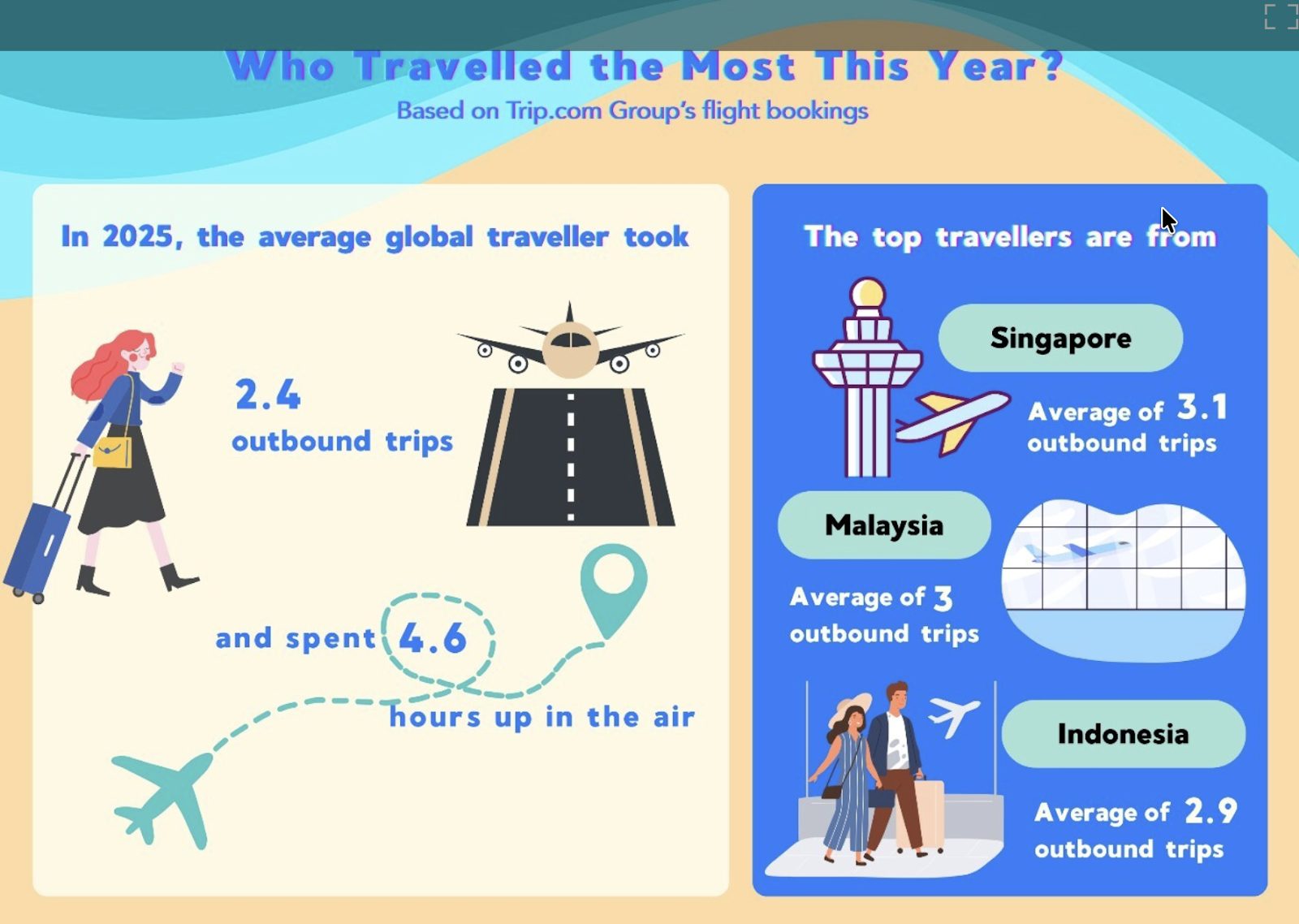

As part of its year-end analysis, Trip.com Group also reviewed global travel behavior in 2025. On average, travelers took 2.4 international trips, with an average flight duration of 4.6 hours. Travelers from Southeast Asia, including Singapore, Malaysia, and Indonesia, ranked among the most frequent flyers, while travelers from the UK and Germany logged the longest average time in the air.

The Bigger Picture

Taken together, these trends point to a travel industry in 2026 that is more global, more experience-led, and more selective. Travelers are increasingly motivated by culture, entertainment, sustainability, and personalization—while also seeking value and flexibility. For destinations, airlines, and travel brands, the challenge will be to balance volume with experience quality as travel demand continues to evolve.

Source: GLO / Trip.com

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.