34

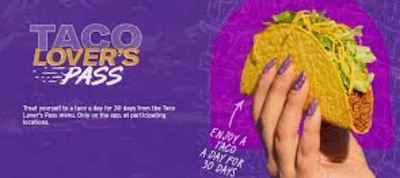

Taco Bell is re-launching its taco subscription program as it seeks to boost customer visits and frequency. The quick-service restaurant (QSR) chain announced its Taco Lover's Pass, which offers loyalty members one free taco every day for 30 days after a $10 purchase. This subscription is available for purchase for…

This content is for logged-in users only.

Login to read the full article.

Login to read the full article.