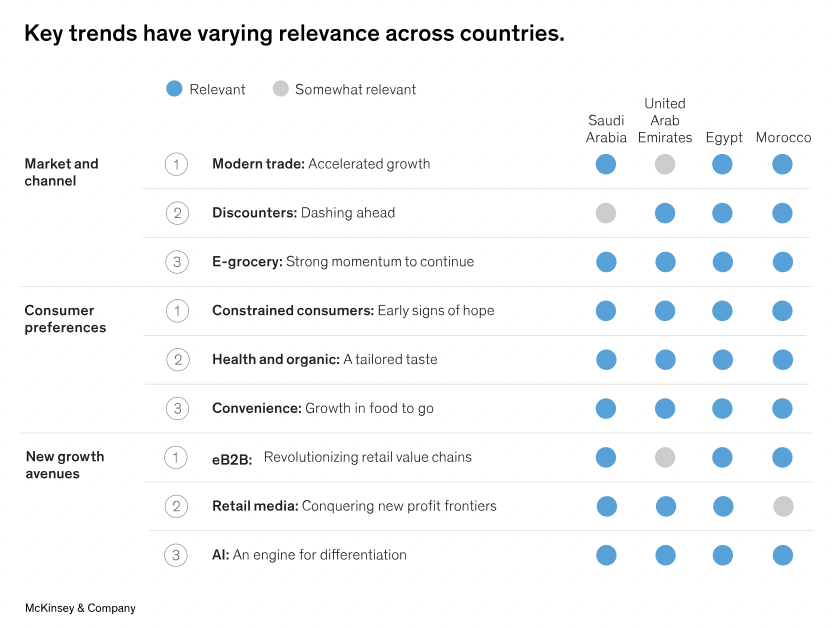

The McKinsey report on MENA's grocery sector highlights strong growth in modern trade, eGrocery, and discount formats, driven by increasing consumer demand for convenience, value, and premium products. Retailers that leverage digital innovations, AI, and emerging eB2B platforms can capitalize on these trends to enhance profitability and meet evolving consumer expectations.

McKinsey & Company.

McKinsey & Company.The McKinsey report “2024 State of Grocery Retail in the Middle East and North Africa” explores key trends shaping the MENA grocery sector and highlights the strategies retailers can adopt to remain competitive and meet evolving consumer needs.

Image: McKinsey & Company

Image: McKinsey & Company

Key takeaways:

1. Modern Trade Growth

- Expansion of Store Networks: Modern trade has continued its upward trajectory across MENA, with Saudi Arabia and the UAE showing steady growth. Countries like Egypt and Morocco have seen rapid increases, driven primarily by new store openings. The region’s high growth potential, particularly in emerging markets, suggests this trend will continue as demand for formalized retail formats grows.

- Investment Opportunities: This growth underscores opportunities for local and international investors, particularly in markets like Egypt and Morocco, where modern trade is still in the minority.

Image: McKinsey & Company

2. Rising eGrocery Demand

- Steady Online Sales Growth: Despite starting from a smaller base, online grocery sales in MENA have grown significantly. For instance, the UAE and Saudi Arabia lead with annual growth rates of 27% and 25%, respectively.

- Future Potential: Although online penetration remains low compared to mature markets, consumer interest is increasing. Approximately one-third of consumers in MENA express intentions to shop more online in the coming years, offering a strong growth outlook for eGrocery.

3. Surge in Discount Formats

- Consumer Demand for Affordability: Discount retailing is gaining traction, with consumers increasingly seeking value. In Egypt, Morocco, Saudi Arabia, and the UAE, discount formats have grown faster than the overall industry, as seen with brands like Kazyon and Viva expanding across the region.

- Future of Discounts: Given the popularity of discounters in mature markets, retailers have substantial room to grow this format across MENA. However, establishing a sustainable discount model remains a challenge that may affect its pace of expansion.

4. Health and Premium Preferences

- Growing Demand for Quality: Even as consumers look for savings, there’s an increasing willingness to spend on premium, healthy, and organic products. High-income consumers, especially in the UAE and Morocco, are driving demand for organic goods, reflecting a shift towards health-conscious choices in the region.

- Potential for Growth: Retailers responding to these demands can boost customer loyalty by curating premium, quality products that align with health trends.

5. Rise of Food-to-Go

- Convenience-Driven Demand: The food-to-go segment, including ready-to-eat meals and delivery services, has surged, outpacing general grocery growth. This trend reflects consumers’ preference for convenience, with the fastest growth in Egypt and Saudi Arabia.

- Opportunity for Retailers: Retailers can tap into this market by enhancing their ready-to-eat options and introducing in-store dining experiences.

6. Expansion of eB2B Market

- Streamlining Small Retail Operations: eB2B is gaining traction as it simplifies supply chains for small, independent stores that dominate in many MENA countries. Platforms like Egypt’s Capiter are connecting merchants directly with suppliers, offering efficiency and cost savings.

- Growth Opportunities: Retailers can capitalize on the eB2B market by developing platforms that support traditional trade, enhancing both reach and profitability.

7. Retail Media and Digital Advertising

- Unlocking New Revenue Streams: Retail media networks are proving profitable for grocery retailers by generating advertising revenue from their digital and physical properties. In MENA, companies like Carrefour and BinDawood Holding are adopting retail media strategies, offering personalized advertising experiences for consumers.

- Profit Potential: With the right scale and advertising capabilities, MENA retailers can tap into this rapidly growing profit source, potentially mirroring the success seen in Europe.

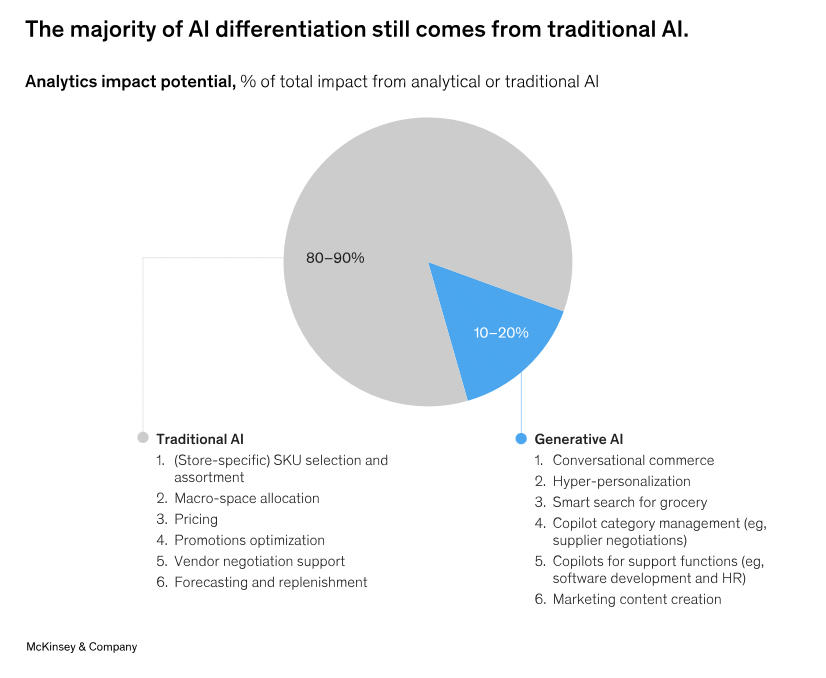

8. Leverage of AI in Retail

- Enhanced Retail Efficiency: While generative AI is emerging, traditional AI applications in pricing, assortment, and promotions already yield significant results. MENA retailers using AI to optimize store operations and customer experiences are expected to gain a competitive edge.

- Strategic Priorities: For continued growth, retailers should focus on integrating AI across their operations to improve customer insights, loyalty programs, and inventory management.

Image: McKinsey & Company

This report underscores that MENA’s grocery sector has enormous potential for growth, especially in modern trade, online grocery, discount formats, and eB2B. Retailers embracing innovation in digital, health-focused products, and convenience-driven formats are well-positioned to succeed in the evolving MENA market.

Source: McKinsey & Co.

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.