Varying vehicle brands, new EV options and personalized communications influence U.S. consumers and create new opportunities for automakers to increase affinity amid the changing landscape in U.S. garages.

GLO

GLOVarying vehicle brands, new EV options and personalized communications influence U.S. consumers and create new opportunities for automakers to increase affinity amid the changing landscape in U.S. garages

LexisNexis® Risk Solutions, a leading provider of data and analytics for the insurance and automotive industries, released findings on how personalized and timely communications play a critical role in strengthening U.S. automotive brand loyalty and driving repeat purchases. The survey examined the motivations and considerations across consumer vehicle purchases and alternative fuel migrations. Through continued automotive brand loyalty analysis, including its most recent U.S. Automotive Brand Loyalty Mid-Year 2025 Study, LexisNexis Risk Solutions provides automakers (OEMs) with a unique view of the relationship between U.S. consumers and their evolving vehicle preferences.

Key Takeaways

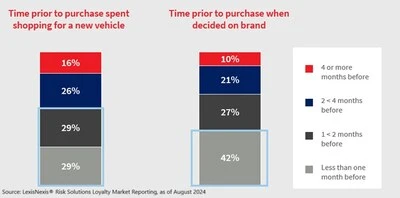

- When deciding on their next vehicle purchase, 42% of U.S. consumers decided on the brand less than one month before purchasing or leasing.

- When considering automotive brands, 57% of respondents were open to switching brands, but still looked for a new vehicle from the same brand, followed by loyalists who only thought about the same brand (31%), and defectors who only considered other brands (12%).

- When looking at multi-brand households, one in four consumers defected to another vehicle brand already in the garage.

- Traditional internal combustion engine (ICE) consumers show the highest brand defection rate when switching to alternative fuel platforms (hybrid/EV), showing a 64% brand defection rate.

Key Observations

“Our survey reveals that while 57% of consumers consider repurchasing the same brand, they are also open to exploring other options. With one in four consumers defecting to another brand already in their garage, affinity plays a powerful role in the final decision,” said Dave Nemtuda, associate vice president, LexisNexis Risk Solutions. “As consumer behaviors evolve, OEMs and their franchise dealerships have a unique opportunity to strengthen loyalty by rethinking how and when they engage. This is where our expertise in data and advanced analytics serves to help automakers better understand consumer preferences – who they would like to hear from and when they want to be contacted.”

Personalized Communication Preferences

More than half (58%) of U.S. consumers started shopping two months prior to purchasing a new vehicle, and the communication they’ve received from OEMs played a role in their purchasing decisions.

Respondents evaluated different types of personalized outreach based on recall and perceived influence, with all forms showing a positive impact on purchase consideration:

- Email communication from an automotive brand ranks highest among preferred channels at 65% followed by direct mail (46%) and text message (27%).

- Financial incentives ranked highest at 87%, followed by loyalty programs (86%). Tied for third were exclusive offers for existing brand owners, as well as detailed information about new features and improvements in new models (both at 85%).

- Additional types of communications that were seen as positive outreach included new vehicle model promotions (84%), competitive offers on current vehicle trade-in values (83%), and personalized invitations to drive new vehicles (82%).

“The increasing shift towards electric and hybrid vehicles presents both an opportunity and a challenge for automakers to retain customers,” said Mike Yakima, product principle for vehicle intelligence solutions at LexisNexis Risk Solutions. “Buyers are receptive to timely, personalized communication across multiple channels, creating more touchpoints to reinforce brand value and trust. Those who embrace this shift can turn changing purchase patterns into a lasting advantage.”

Automakers looking to improve customer retention and attract new buyers can gain access to the complete survey findings by visiting the website. The insight can help auto manufacturers refine their outreach strategies and enhance customer engagement using affinity and garage-level preference information.

About LexisNexis Risk Solutions

LexisNexis® Risk Solutions harnesses the power of data, sophisticated analytics platforms and technology solutions to provide insights that help businesses across multiple industries and governmental entities reduce risk and improve decisions to benefit people around the globe. Headquartered in metro Atlanta, Georgia, we have offices throughout the world and are part of RELX (LSE: REL/NYSE: RELX, a global provider of information-based analytics and decision tools for professional and business customers. For more information, please visit www.risk.lexisnexis.com, and www.relx.com.

SOURCE LexisNexis Risk Solutions

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.