The International Air Transport Association (IATA) reported a 2.6% year-on-year increase in global passenger demand for June 2025, though growth slowed compared to previous months due to disruptions from Middle East conflicts. While international and domestic markets both recorded moderate gains, capacity growth outpaced demand in several regions, leading to slight declines in load factors, though global levels remained strong at 84.5%.

GLO

GLOThe International Air Transport Association (IATA) has published traffic results for June 2025, revealing that global passenger demand, measured in revenue passenger kilometres (RPK), rose by 2.6% compared with June 2024. However, the growth rate was slower than the gains recorded in earlier months.

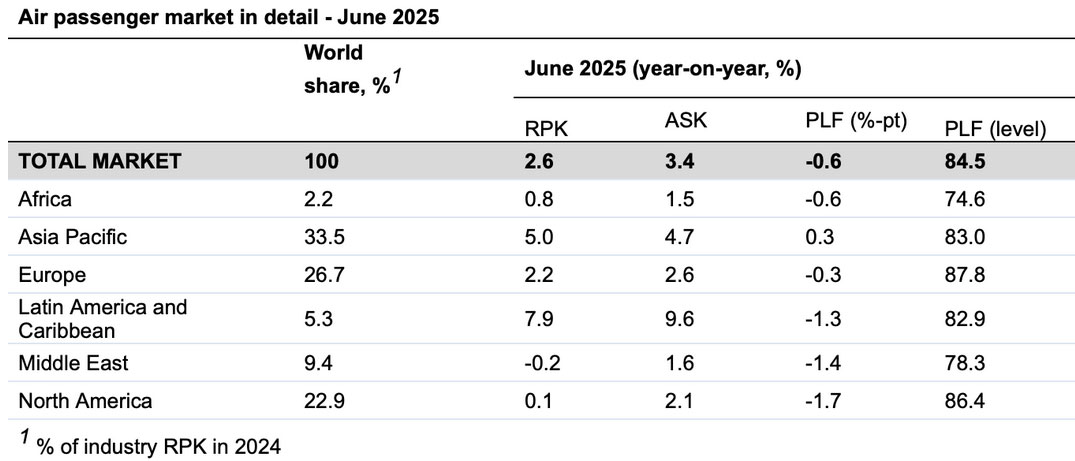

Overall capacity, assessed in available seat kilometres (ASK), grew 3.4% year-on-year. The average load factor for June reached 84.5%, a decline of 0.6 percentage points compared to the same month last year.

International passenger traffic increased 3.2% from June 2024, with available capacity climbing 4.2%. Despite this, the load factor slipped to 84.4%, down 0.8 percentage points year-on-year. On the domestic front, demand was up 1.6% compared to June 2024, with capacity rising 2.1%. The domestic load factor stood at 84.7%, 0.4 percentage points lower than the year before.

Commenting on the results, IATA Director General Willie Walsh said: “Passenger demand in June rose by 2.6%, a slower pace than we had seen in prior months, largely due to disruptions from ongoing military conflict in the Middle East. With demand growing more slowly than the 3.4% capacity expansion, global load factors slipped 0.6 percentage points from last year’s record-high levels. Nevertheless, at 84.5%, load factors remain very strong. Looking ahead, with August schedules showing only a modest 1.8% increase in capacity, we expect load factors during the northern summer to remain close to recent historic highs.”

Regional Trends – International Passenger Markets

In June, international RPK rose 3.2% year-on-year, though every region experienced a drop in load factor as capacity increases surpassed demand. The sharpest decline compared to May came from the Middle East, where international traffic contracted 0.4% year-on-year under the impact of regional conflict.

-

Asia-Pacific carriers posted the strongest growth, with demand up 7.2% year-on-year. Capacity grew 7.5%, while the load factor slipped slightly to 82.9% (down 0.2 percentage points).

-

European airlines reported a 2.8% rise in demand versus June 2024. Capacity climbed 3.3%, bringing the load factor to 87.4%, 0.4 percentage points lower than the year before.

-

North American carriers saw a 0.3% decline in traffic, despite a 2.2% increase in capacity. Their load factor fell to 86.9%, a significant 2.2 percentage point drop.

-

Middle Eastern airlines recorded a 0.4% year-on-year decrease in demand, with capacity growing 1.1%. The load factor dropped to 78.7%, down 1.2 percentage points. Routes to North America (-7.0%) and Europe (-4.4%) were particularly affected by the ongoing military conflict.

-

Latin American carriers achieved the strongest performance after Asia-Pacific, with traffic up 9.3%. Capacity surged 11.8%, but the load factor declined to 83.3%, a fall of 1.9 percentage points.

-

African airlines experienced a 0.3% decline in demand, while capacity grew by the same margin. The load factor fell to 74.6%, 0.5 percentage points lower, with the decline attributed in part to rising competition from European and Middle Eastern operators.

Source: IATA

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.