Revenue growth of 9.0% driven by our market-leading network, strong brands and operational focus

• Operating profit before exceptional items increased by 26.7% to €4,443 million (2023: €3,507 million) as we continue to execute

our transformation programme

• Structural improvements delivering a world-class operating margin before exceptional items of 13.8% (2023: 11.9%)

IAG

IAGDelivering sustainable shareholder value creation

Luis Gallego, IAG Chief Executive Officer, said: “These results highlight the quality of our businesses and effectiveness of our strategy, underpinned by the successful execution of our transformation programme across the Group. We are delivering world-class margins and returns, in line with the targets we set out to the market just over a year ago.

“We are focused on continuing to make our brands the first choice for customers, by growing our network and enhancing the customer proposition, while our disciplined capital allocation ensures we can continue to invest in the business, deliver strong financial results and create sustainable value for our shareholders.

“We are particularly pleased to announce that IAG is proposing a final dividend which takes our total dividend for the year to €435 million and intend to return up to a further €1 billion of excess capital to shareholders in up to 12 months.

“This performance would not have been possible without the hard work and dedication of our people, who continue to drive our Group-wide transformation.”

Image: BA/IAG

Image: BA/IAG

Highlights:

Summary

• Revenue growth of 9.0% driven by our market-leading network, strong brands and operational focus

• Operating profit before exceptional items increased by 26.7% to €4,443 million (2023: €3,507 million) as we continue to execute

our transformation programme

• Structural improvements delivering a world-class operating margin before exceptional items of 13.8% (2023: 11.9%)

• Free cash flow of €3,556 million, after investing €2,816 million into the business

• Return on invested capital of 17.3%, as a result of disciplined capital allocation

• Delivering sustainable value creation for our shareholders

• Adjusted earnings per share growth of 12.3%

• Proposing a final dividend of €0.06 per share, taking full year 2024 dividend to €0.09 per share

• €350 million share buyback announced in November 2024

• Intention to return up to a further €1 billion of excess capital in up to 12 months

Executing on our strategy and our transformation programme

Our strategic initiatives are strengthening our market-leading network, brands and operations:

• Improving operational efficiency: 12.3 ppts improvement in On Time Performance at British Airways and 6.9 ppts at Aer Lingus.

Iberia and Vueling remain two of the world’s most punctual airlines

• British Airways benefitting from its £7 billion transformation programme, with operating profit of £2,048 million (2023: £1,344

million) and a 14.2% margin, making good progress towards its 15% medium-term ambition

• €1,427 million operating profit before exceptional items achieved by our Spanish businesses, already close to our €1.5 billion

ambition

• Capital-light earnings growth from IAG Loyalty: operating profit growth of 14.4% to £420 million at a 17.3% margin

• Benefitting from longer term employee agreements that align to improvements in financial and operational performance

• Sustainability: 1.9% SAF used in total in 2024; on track for the required 2% mandate for 2025

Disciplined capital allocation

• Increasingly strong balance sheet, with net debt to EBITDA before exceptional items at 1.1x (2023: 1.7x)

• Targeting to strengthen the balance sheet further by reducing gross leverage over time (31 December 2024: 2.5x)

• €577 million debt repurchase executed in January 2025

• Two thirds of 2025 aircraft deliveries planned to be unencumbered

• Prioritising an ordinary dividend which is sustainable through the cycle

• Targeting to distribute excess cash when net leverage is below 1.2x to 1.5x, with consideration to the outlook and depending on

future capital requirements and commitments, including M&A opportunities

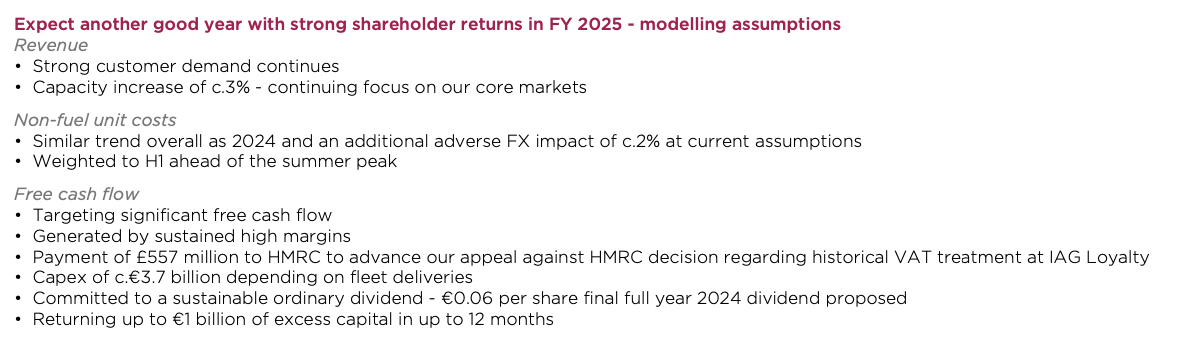

Outlook

• Confident to deliver world-class margins and returns

• Strong customer demand continues

• Non-fuel unit cost trends similar to 2024 (excluding adverse FX impact)

• Significant free cash flow whilst investing in the business

• Sustainable ordinary dividend in place

• Excess capital returns to shareholders, reflecting confidence in the outlook

• Expecting to deliver sustainable earnings per share growth

Source: IAG

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.