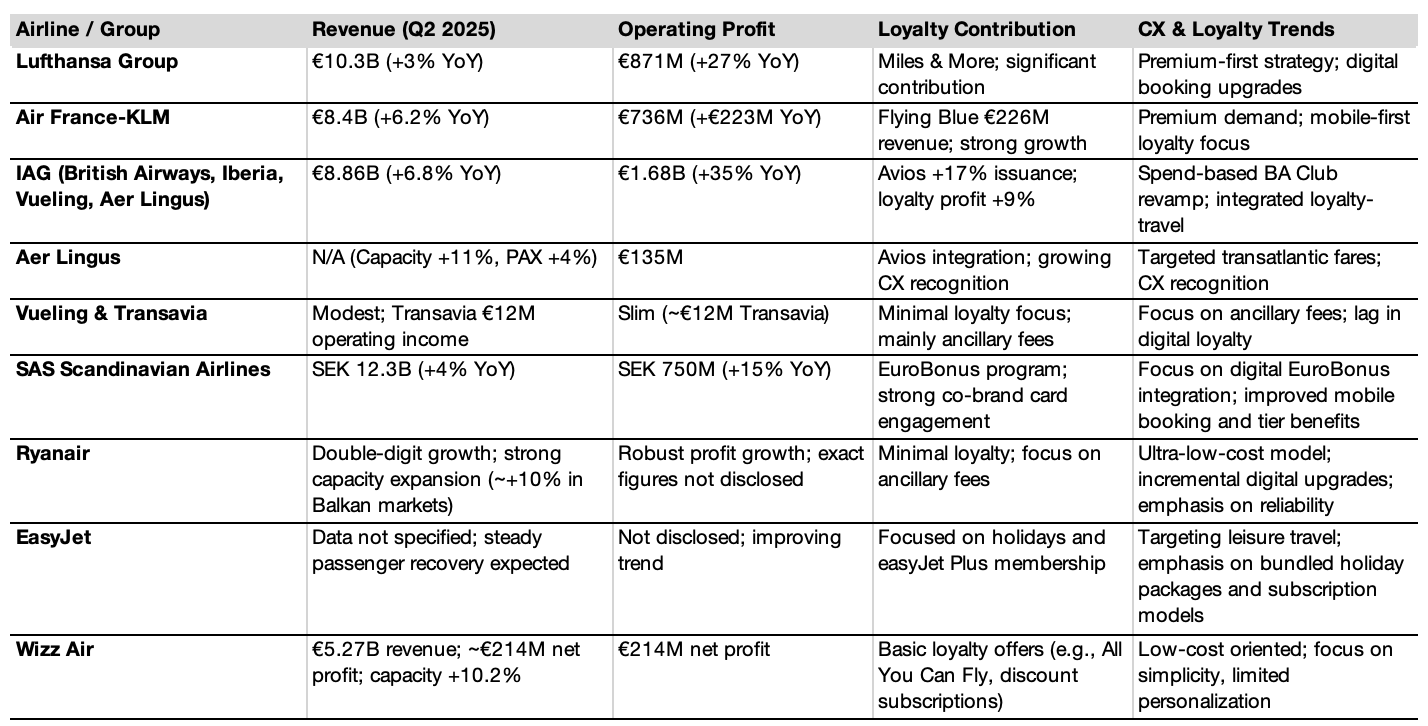

European airlines posted strong Q2 2025 results, with network carriers like Lufthansa, Air France-KLM, IAG & SAS boosting profits through premium demand, loyalty programs, and ancillary revenues, while low-cost rivals Ryanair, EasyJet & Wizz Air focused on capacity growth and fee-based income. Loyalty programs such as Miles & More, Flying Blue, Avios, & EuroBonus emerged as key profit engines, while budget carriers remained reliant on volume and ancillary fees with limited loyalty engagement.

GLO

GLOAcross Europe’s major carriers, premium cabin demand, loyalty revenues, and ancillary fees have become core financial levers. Flag carriers benefited from strong transatlantic and business-class demand, while low-cost airlines expanded volume—but margins remain constrained without deep loyalty engagement.

Airline-by-Airline Q2 2025 Results & Loyalty Insights

Lufthansa Group

-

Financials: €10.3 billion revenue (+3%), adjusted EBIT €871 million (+27%), net profit ~€1.01 billion.

-

Loyalty & CX: Monetization of Miles & More, digital upgrades, improved punctuality, and a premium-first strategy.

Air France‑KLM

-

Financials: €8.4 billion revenue (+6.2%), €736 million operating profit, cargo revenue ~€565 million (+3.6%).

-

Loyalty & CX: Flying Blue loyalty drove ~€226 million revenue. Focus on mobile-first engagement and premium cabin product enhancements.

IAG (BA, Iberia, Vueling, Aer Lingus)

-

Financials: €8.86 billion revenue (+6.8%), €1.68 billion operating profit (+35%); Avios loyalty issuance +17%, loyalty profit +9%.

-

Loyalty & CX: BA Club transition; loyalty members generate 30% more holiday bookings; tiered rewards and improved digital integration.

Aer Lingus

-

Financials: Capacity +11%, passenger volume +4%, operating profit €135 million.

-

Loyalty & CX: Integrated into Avios ecosystem; strong CX recognition and premium transatlantic growth.

SAS Scandinavian Airlines

-

Financials: While full Q2 specifics aren’t disclosed, SAS’s EuroBonus program exceeds 8 million members, and in 2024 generated €4.1 billion in revenue. The airline reported several days with over 100,000 daily passengers in 2025, hitting highest operational volume since 2019.

-

Loyalty & CX: EuroBonus remains central, with new SkyTeam promotions offering up to one million bonus points. SAS rolled out free high-speed Starlink Wi-Fi and launched loyalty integrations (e.g., points exchange with Scandic hotel group) to elevate digital CX.

Ryanair

-

Financials: Q2 FY2025 marked by double-digit revenue and passenger growth, strong capacity expansion (~+10% in Balkan markets).

-

Loyalty & CX: Ryanair continues to rely on ultra‑low fare model and ancillary fees. Loyalty programs remain minimal; CX improvements focus on reliability and incremental digital upgrades.

Wizz Air

-

Financials: FY2025 revenue ~€5.27 billion; net profit ~€214 million; capacity expanded ~10.2% over former-Yugoslav routes in Q2.

-

Loyalty & CX: Offers limited membership benefits like “All You Can Fly” and discount subscription tiers. Loyalty structures are underdeveloped; CX remains low-cost oriented with limited personalization.

Loyalty & CX Themes by Airline Type:

Network / Flag Carriers

-

Loyalty schemes (Miles & More, Flying Blue, Avios) now contribute 10–15% of revenue.

-

Premium cabins and co-brand credit cards deepen engagement through tiered maintenance.

-

Digital-first CX—with apps, instant promotions, and personalized messaging—is now a retention priority.

Low-Cost & Ultra-Low-Cost Carriers

-

Generating revenue primarily through ancillary fees (baggage, seat selection, subscriptions). Loyalty is minimal or transactional.

-

CX focus remains on operational reliability, cost clarity, and simplicity—tailored to budget travelers.

Country-Level Highlights

-

Germany: Lufthansa focuses on operational turnaround and maximizing Miles & More forms part of loyalty strategy.

-

France/Netherlands: Air France-KLM elevates Flying Blue via long-haul and premium travel ecosystem.

-

UK & Ireland: IAG revamps loyalty model (BA Club) while Aer Lingus integrates CX and loyalty through Avios.

-

Scandinavia: SAS EuroBonus continues to grow, leveraging SkyTeam offers and digital enhancements like free Wi-Fi and hotel loyalty integration.

-

Centraleastern Europe: Wizz and Ryanair lead in seat growth, but have yet to translate traffic into sophisticated loyalty differentiation.

European flag carriers are capitalizing on loyalty and premium demand to power Q2 2025 profits. Loyalty programs have evolved into strategic revenue engines, while low-cost carriers still rely on volume and ancillary income. Brands investing in digital loyalty integration, personalized CX, and premium product bundles are best positioned to sustain margins and drive engagement in a competitive market.

Source: GLO

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.