According to a report from FTI Consulting, U.S. online retail sales are projected to grow 9.8% to $1.2 trillion in 2024. E-commerce will account for 22.7% of the total retail market, up from 21.6% last year. In Q1, online sales made up 57% of total U.S. retail sales, marking the highest rate since 2017, excluding the pandemic years.

GLO

GLOFTI Consulting released its regular retail report. Access full report here.

According to a report from FTI Consulting, U.S. online retail sales are projected to grow 9.8% to $1.2 trillion in 2024. E-commerce will account for 22.7% of the total retail market, up from 21.6% last year. In Q1, online sales made up 57% of total U.S. retail sales, marking the highest rate since 2017, excluding the pandemic years.

E-commerce is shifting to a more stable growth phase, moving from pre-pandemic mid-teen growth rates to single-digit increases. FTI Consulting predicts e-commerce market share will plateau at around 35% in the next decade, with categories like toys, electronics, and books already reaching that threshold.

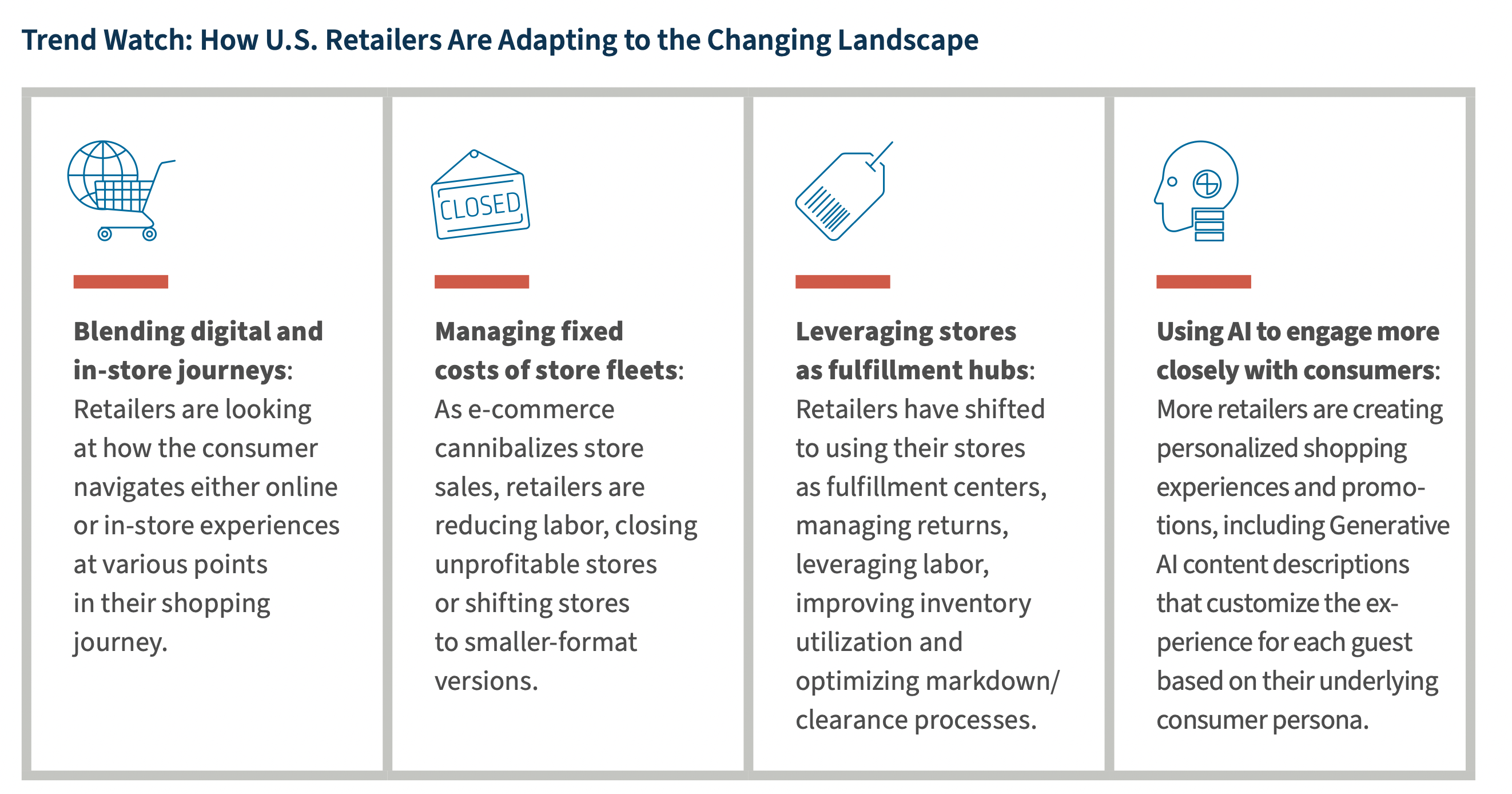

As e-commerce matures, store-based retailers continue losing ground. Businesses are responding by integrating omnichannel strategies, leveraging AI, and repurposing stores as fulfillment centers. According to Forrester, U.S. online sales could hit $1.6 trillion by 2028, representing 28% of total retail sales.

Key takeaways and trends to watch:

- U.S. e-commerce sales are projected to reach $1.2 trillion in 2024, marking a 9.8% growth from the previous year.

- E-commerce will account for 22.7% of the total U.S. retail market, up from 21.6% in 2023.

- E-commerce sales growth accounted for 57% of total retail sales growth in Q1 2024, the highest since 2017 (excluding the pandemic period).

- E-commerce growth has entered a maturing phase, with high to mid-single-digit growth expected in the coming years, replacing the pre-COVID mid-teen growth rate.

- Market share gains for e-commerce have resumed following a post-pandemic lull, with a 110 basis point increase in the last 12 months.

- E-commerce market share is expected to plateau at around 35% by the next decade, though categories like electronics, books, and toys have already reached this level.

- New e-commerce players like Temu, Shein, and TikTok Shop are disrupting the U.S. market with competitive prices and efficient supply chains, particularly in the apparel and home goods sectors.

- Retailers are adapting by integrating online and offline channels, repurposing stores as fulfillment centers, and leveraging AI for personalized shopping experiences.

- Amazon continues to dominate U.S. e-commerce, accounting for 42% of sales in 2023, with its third-party (3P) sales seeing significant growth.

- Store closures are expected to accelerate, with an estimated 45,000 U.S. retail stores closing by 2028 as e-commerce continues to gain market share.

Image: FTI

Source: FTI:

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.