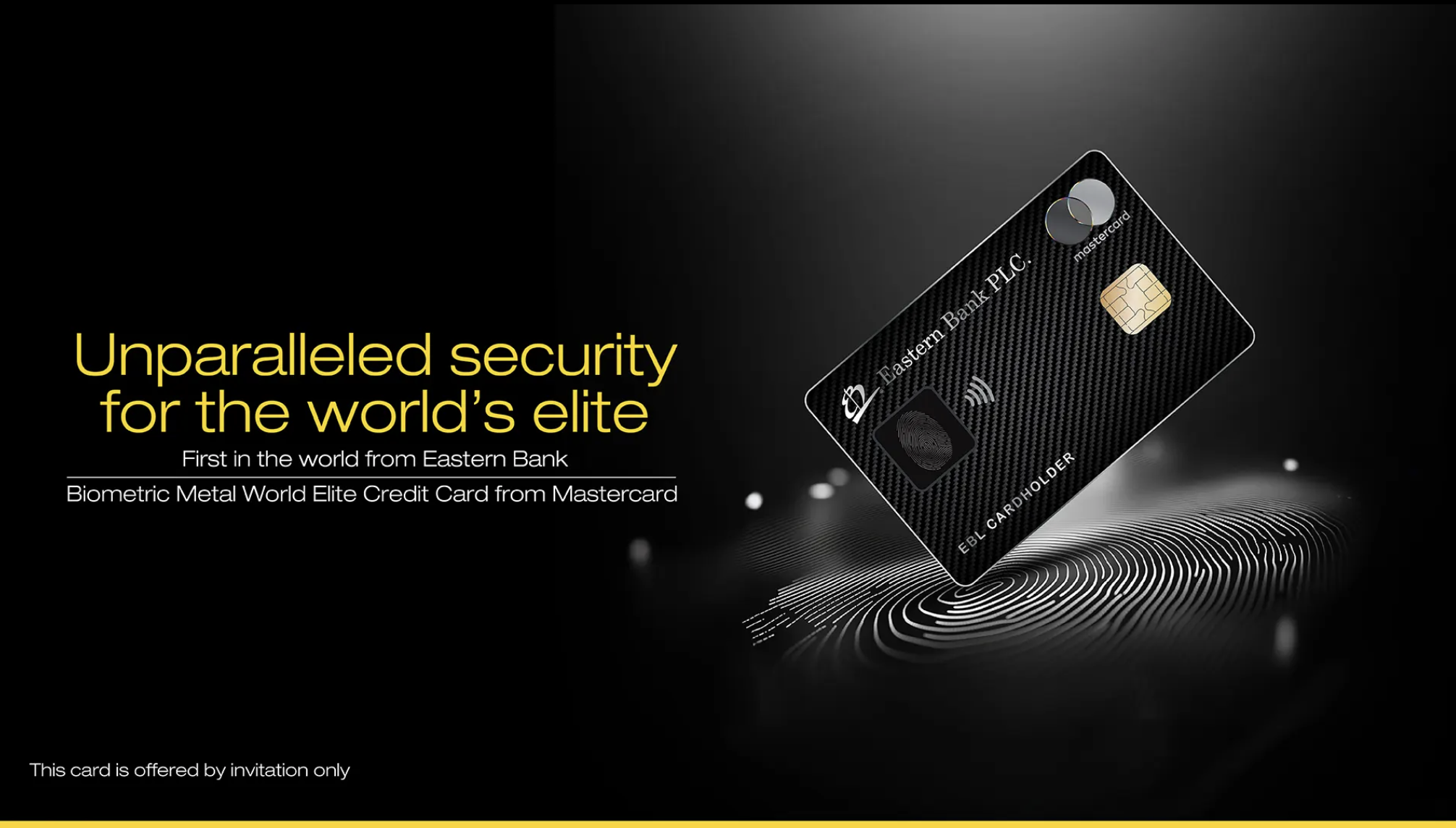

Eastern Bank PLC of Bangladesh, in partnership with Mastercard, launched the world’s first commercially available biometric metal credit card under the World Elite tier in 2025. The card uses fingerprint authentication for in-store payments, combining premium metal design with advanced security. The launch highlighted how next-generation card technology is being introduced through ultra-premium segments. (Image: EBL)

Mastercard

Mastercard31 July 2025

In early 2025, Eastern Bank PLC (EBL) of Bangladesh, in partnership with Mastercard, unveiled a product that sounded like it belonged in a concept lab rather than a bank branch: a biometric metal credit card that allows customers to authenticate in-store purchases using a fingerprint. Issued under the World Elite Mastercard tier, the card was positioned as the world’s first commercially available biometric metal credit card, and it quickly became one of the most widely discussed card-network innovations of the year.

Beyond the novelty, the launch offered a clear signal of where premium payments are heading: stronger authentication, distinctive physical design, and a renewed push to keep the physical card relevant in a digital-wallet world.

Image: EBL

What exactly launched?

The product, officially branded as the EBL Mastercard World Elite Biometric Metal Credit Card, combines two features that had rarely been seen together at commercial scale:

-

A built-in fingerprint sensor for transaction authentication

-

A metal card body, typically associated with ultra-premium banking products

According to the bank and network, this was not a pilot or limited trial, but a commercial issuance available to eligible World Elite customers in Bangladesh. That “commercial first” claim—rather than a lab demonstration—was central to the card’s global visibility.

How fingerprint authentication on a card works

Biometric payment cards follow a relatively straightforward architecture:

-

Enrollment: The cardholder registers their fingerprint once, either in a branch or using a secure enrollment method.

-

On-card storage: The fingerprint is converted into a secure template and stored on the card itself, not in a central database.

-

Transaction: When making a purchase, the cardholder places a finger on the sensor while tapping or inserting the card. If the fingerprint matches, the transaction proceeds.

In most designs, fingerprint verification replaces or supplements PIN or signature verification, depending on terminal behavior and transaction type. The emphasis on on-card storage is crucial, as it addresses privacy concerns and reduces reliance on external systems.

The EBL card was developed with technology partners specializing in biometric sensors, secure elements, and card manufacturing—highlighting that biometric cards are ecosystem products rather than single-vendor solutions.

Why the “metal” part matters

Metal cards are already a recognized symbol of status in premium banking. Their weight, finish, and durability communicate exclusivity in a way plastic cards cannot. Combining biometrics with a metal form factor does more than improve aesthetics:

-

It reinforces the premium positioning of biometric authentication

-

It differentiates the card physically and emotionally from standard products

-

It aligns higher manufacturing costs with customers who expect and can justify them

In this context, metal is not just a material choice—it is part of the product’s identity.

Premium strategy: security as a lifestyle feature

The decision to issue the biometric card under the World Elite tier is telling. World Elite products are designed for high-net-worth customers who value convenience, recognition, and exclusivity as much as financial functionality.

Rather than marketing biometrics purely as a fraud-prevention tool, the card frames fingerprint authentication as effortless luxury—a faster, more elegant way to pay. This mirrors a broader trend in premium financial services, where security upgrades are packaged as lifestyle enhancements alongside travel privileges, dining programs, and concierge services.

Why this launch drew global attention in 2025

Several factors helped the EBL–Mastercard card stand out in an already crowded fintech news cycle:

-

A clear “world’s first” narrative: Few innovations come with a claim that is easy to understand and repeat.

-

A major network backing: Mastercard’s involvement gave the product immediate credibility and global reach.

-

A real bank, real customers: This was not a startup experiment, but a regulated bank issuing to actual cardholders.

-

Timing: As digital payments mature, attention is shifting from adoption to experience and security—making biometrics a natural focal point.

Together, these elements turned a single-market launch into a global case study.

Practical challenges and limitations

Despite the buzz, biometric cards face real hurdles:

-

Enrollment complexity: Fingerprint registration must be simple and reliable to avoid customer frustration.

-

Cost: Sensors and metal construction increase unit costs, limiting near-term mass-market adoption.

-

Merchant experience: Cardholders must understand how and when to place their finger to avoid confusion at checkout.

-

Trust and perception: Even with on-card storage, some users remain cautious about biometric data tied to financial products.

These challenges explain why biometric cards are currently concentrated in premium tiers rather than mainstream issuance.

Why it matters beyond Bangladesh

The significance of the EBL biometric metal card lies less in volume and more in proof of viability. It demonstrates that:

-

Premium segments are becoming innovation sandboxes for networks and issuers.

-

Physical cards can still evolve, even as mobile wallets dominate everyday payments.

-

Authentication is becoming experiential, not just technical.

By moving biometric metal cards from pilot to commercial reality, Eastern Bank and Mastercard showed that next-generation card technology can be sold, branded, and sustained in the real world.

Eastern Bank PLC’s World Elite biometric metal credit card stands as one of 2025’s most visible payments innovations—not because it will immediately replace plastic cards, but because it reframes what a premium card can be. It blends security, design, and status into a single object, signaling that the future of card payments may be as much about experience as it is about transactions.

Source: EBL / GLO

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.