D-edge covers implications of Digital Markets Act implementation for hospitality and hotels industries, including significant drop in free traffic, increased dependence on paid traffic, rising distribution costs, unfavourable shift in channel distribution mix.

GLO

GLOD-edge covers implications of Digital Markets Act implementation for hospitality and hotels industries.

Read full article here.

Key Takeways:

Digital Markets Act is a new legislation by the European Commission aimed at curbing the power of online “gatekeepers” like GAFA (Google, Apple, Facebook, and Amazon) to promote fair competition and offer consumers more choices in the digital marketplace. The DMA entered into force on 1 November 2022 and become applicable on 2 May 2023. For hotels in Europe, the DMA was expected to create a more level playing field, increasing transparency about how to improve rankings and visibility on these platforms, giving more control over distribution, and reducing dependency on OTAs.

Google Hotel Search Page Changes:

Google has not reported any details, but several key changes to search result pages for hotel-related queries are evident, including:

- Organic results are pushed further down the page, making them less visible.

- The introduction of a new bloc “ places” gives more space to OTAs and Metasearch.

Other notable changes that affect the user experience include:

- Stay dates can only be changed by clicking through to Google Hotels pages and clicking the Dates tab in the newly designed menu.

- Users cannot click Google Maps in the Knowledge Panel for a larger view.

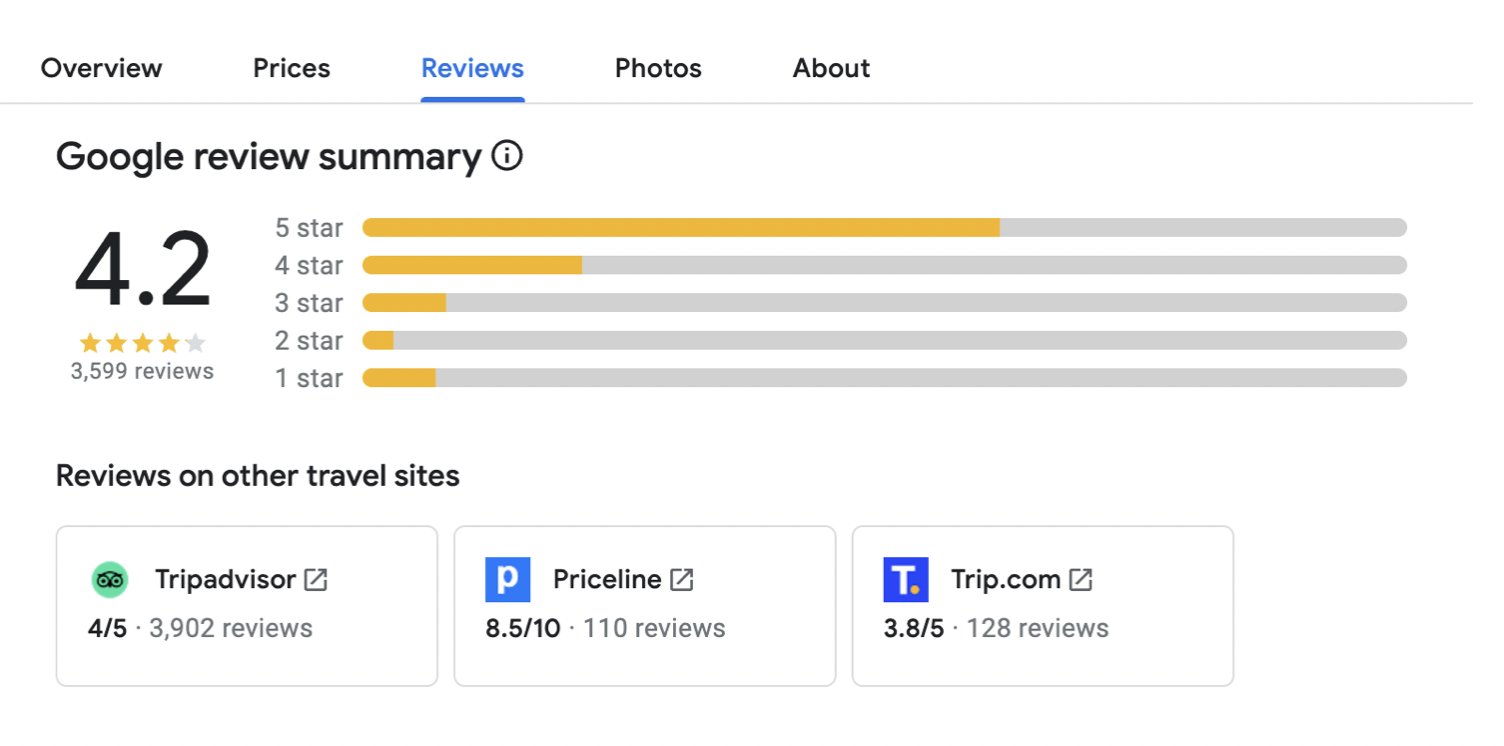

- Guest reviews from various sources are now included with Google reviews.

Key implications for hotels (d-edge analysed website traffic and digital booking data for a broad selection of independent hotels and small hotel groups in the EU (during January 1, 2024, when most of the changes took effect, to April 28, 2024, and compared to the same period last year):

1. Significant drop in free traffic

- The share of direct revenue from organic and unpaid traffic on Google has decreased from 66% to 57%

- Organic Traffic Decline: There has been a 20% drop in organic traffic to hotel websites, likely due to organic links appearing much lower in search results.

- Free Booking Links Revenue Fall: Revenue from Free Booking Links has dropped by 32%. Despite the placement remaining the same, changes in the overall page display could explain the 41% drop in clicks.

2. Increased dependence on paid traffic

- The share of direct revenue from Google paid campaigns has risen sharply, from 34% to 43%, with Google Ads (Search Marketing) accounting for 39% of clicks.

3. Rising distribution costs

- This shift has led to a 18% increase in direct distribution costs, with average direct distribution costs rising from 3.3% to 3.9% of revenue. However, direct costs remain three times less expensive than indirect costs on average.

4. Unfavourable shift in channel distribution mix

- Direct booking revenue share has fell by 4.3% to an average of 28.1%, while OTA revenue market share has grown to 62.7%, and other indirect sources (mostly Hotelbeds) have increased to 9.1%.

- Given that total digital revenue was up by 11% during this period, some hotels may have missed these important shifts in traffic, revenue, and market share.

Breakdown of online hotel bookings revenues

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.