Chase will become the new issuer of the Apple Card, adding Apple to its co-brand credit card portfolio. The partnership highlights both companies’ focus on innovation and strengthens Chase’s position in digital consumer finance, while ensuring continuity for Apple Card users within Apple’s ecosystem. (Image: Chase)

09 January 2026

Apple and Chase have announced a landmark agreement that will see Chase become the new issuer of Apple Card, with the transition expected to take place over approximately 24 months. The announcement was made on January 7, 2026, from Wilmington, Delaware.

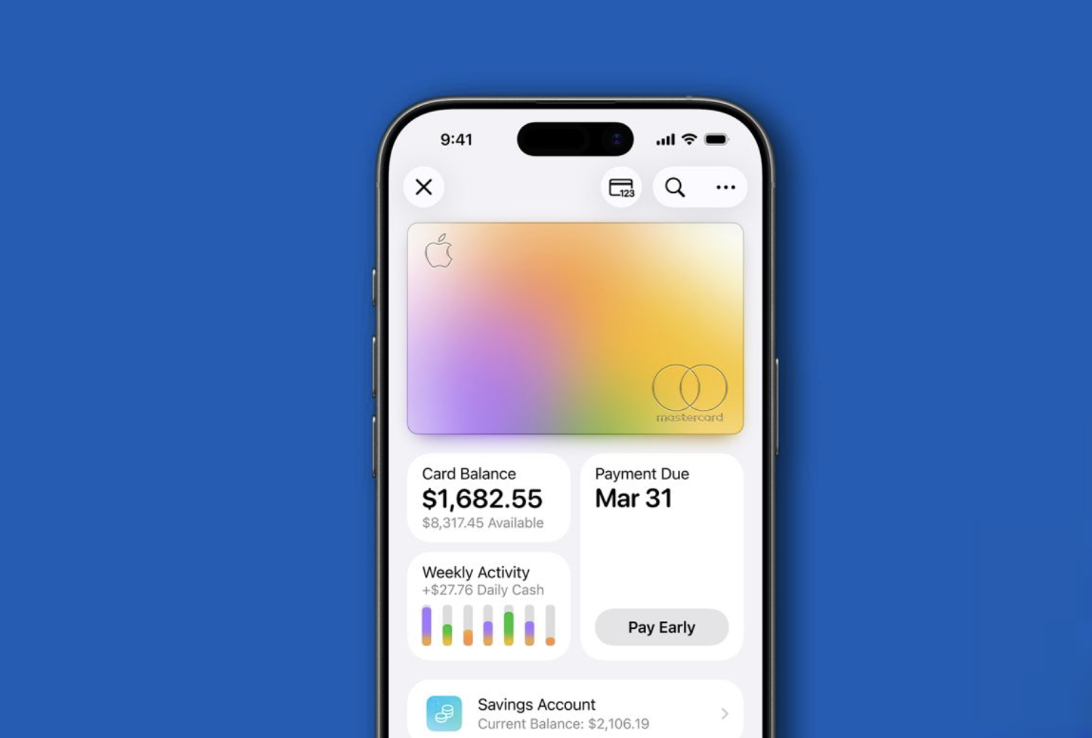

Under the new partnership, Apple Card users will continue to enjoy the features that have defined the product since its launch, including up to 3 percent unlimited Daily Cash back, detailed spending insights within Apple Wallet, Apple Card Family, access to a high-yield Savings account, and privacy-focused design. Mastercard will remain the payment network, ensuring global acceptance and continuity of benefits for cardholders.

Image: Chase

Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said the company is proud of how Apple Card has reshaped the credit card experience by helping users make healthier financial decisions. She added that Chase shares Apple’s commitment to innovation and customer experience, and that the companies look forward to delivering best-in-class service together.

Allison Beer, chief executive officer of Card & Connected Commerce at Chase, described Apple as an iconic global brand and said the partnership deepens Chase’s co-brand credit card portfolio. She emphasized a shared focus on consumer financial health and said the companies are excited to innovate together in the years ahead.

Mastercard president of the Americas Linda Kirkpatrick said the company is pleased to continue its longstanding partnership on Apple Card, highlighting the card’s role in advancing simple, secure and seamless payments at global scale.

Introduced in 2019, Apple Card has become a popular choice for U.S. consumers thanks to its fee-free structure, intuitive spending tools and strong emphasis on privacy and security. Users can manage their card entirely through Apple Wallet, receive Daily Cash rewards that can be spent instantly or deposited into Savings, and finance Apple products interest-free through Apple Card Monthly Installments. Apple Card Family also allows account sharing within an Apple Family Sharing group.

During the transition period, Apple Card holders can continue using their cards as normal, with no immediate changes required. Apple and Chase said additional details and customer communications will be shared closer to the transition date, with FAQs available online.

As part of the agreement, Chase is expected to acquire more than $20 billion in Apple Card balances, bringing them onto its platform. The transaction, subject to regulatory approval, is not expected to close for around two years. JPMorgan Chase & Co. expects to record a $2.2 billion provision for credit losses in the fourth quarter of 2025 related to the forward purchase commitment.

Apple Card is currently issued by Goldman Sachs Bank USA, which will remain involved during the transition. Both Apple and Chase stressed that the goal is a smooth handover that preserves the Apple Card experience customers have come to expect.

Apple Card is subject to credit approval, available only for qualifying applicants in the United States, and issued by Goldman Sachs Bank USA, Salt Lake City Branch.

Apple Payments Services LLC, a subsidiary of Apple Inc., is a service provider of Goldman Sachs Bank USA for Apple Card and Savings accounts. Neither Apple Inc. nor Apple Payments Services LLC is a bank.

About Chase

Chase is the U.S. consumer and commercial banking business of JPMorgan Chase & Co. (NYSE: JPM), a leading financial services firm based in the United States of America with assets of $4.6 trillion, $360 billion in stockholders’ equity as of September 30, 2025, and operations worldwide. Chase serves more than 85 million consumers and 7 million small businesses with a broad range of financial services, including personal banking, credit cards, mortgages, auto financing, investment advice, small business loans and payment processing. Customers can choose how and where they want to bank: more than 5,000 branches in 48 states and the District of Columbia, nearly 15,000 ATMs, mobile, online and by phone. For more information, go to chase.com.

Source: Chase / GLO

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.