Rewards net revenue grew by 45% YoY due to higher point issuance and improved point redemption rates. To grow, AirAsia MOVE focuses on onboarding more external partners to join the rewards programme.

AirAsia

AirAsia

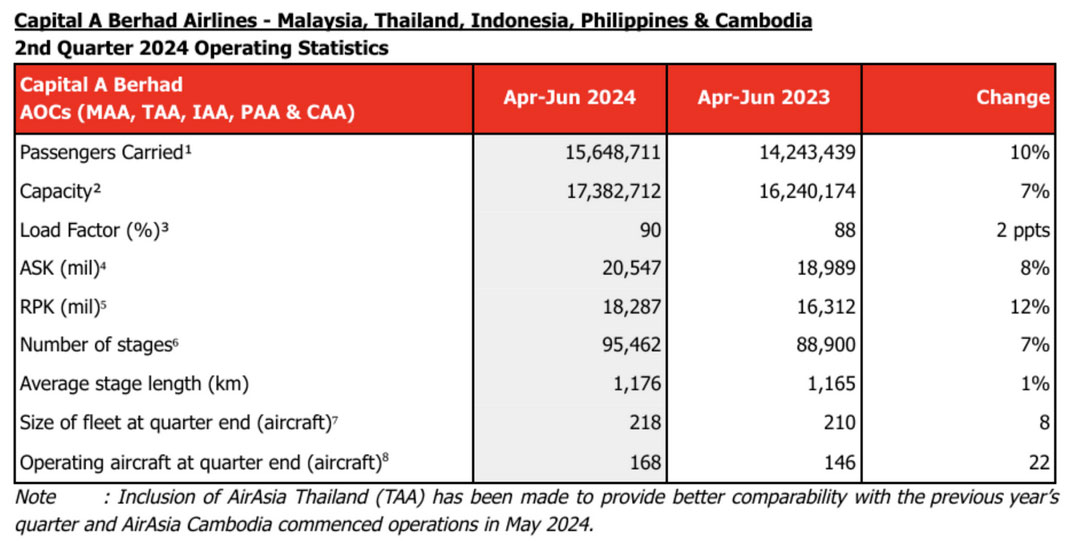

Capital A has announced operating statistics for its Capital A Aviation Services (CAPAS) for the second quarter of the financial year 2024, indicating the group’s airlines achieved a 90% load factor and flew more than 15.6 million passengers.

Emerging from a seasonal peak in the first quarter, the aviation group – AirAsia Malaysia, AirAsia Thailand, AirAsia Indonesia, AirAsia Philippines, and AirAsia Cambodia — maintained its record-breaking quarterly load factor of 90% in 2Q2024, up by two percentage points year-on-year due to increased capacity.

As of the end of June, the group had reinstated 195 aircraft out of its total fleet of 218 – an additional eight aircraft were reactivated during the quarter. During the 1H2024, the airline reported more than 30 million passengers carried.

Passenger volume continued its upward trajectory, rising by 11% YoY to reach 15.6 million during the 2Q2024. This outpaced capacity growth of 7%, demonstrating resilience in regional travel demand. Routes to China and India were among the strongest, boasting a robust Year-to-Date (“YTD”) load factor of 91%, following visa-free travel implementation at the end of 2023 for China and India travellers. Additionally, both domestic and international segments are experiencing similar growth rates, indicating a holistic recovery across AirAsia’s network. Excluding Cambodia, passenger numbers are nearing pre-pandemic levels, with YTD recovery reaching 84% of pre-Covid figures, surpassing capacity recovery of 81%.

AirAsia MOVE

AirAsia MOVE has transitioned this year from being a super app that offers grocery shopping and food delivery to becoming a travel platform. The focus is to grow flights, hotels, and airport rides as well as build duty-free and activity products. The priority is to grow the app user, as it provides a higher lifetime value. While overall Monthly Active Users (MAUs) are down by 13% YoY, the app’s MAUs have increased by 10% YoY.

Travel: Flight overall transactions are down due to value challenges within the OTA landscape. In response, AirAsia MOVE is enhancing its fare-tracking system and driving targeted promotions to regain competitiveness. Recovery is expected in 3Q2024 and will be back to the 2023 level by 1Q2025. Conversely, Hotels are on a strong trajectory, posting a 33% YoY growth mainly attributed to improved personalisation and inventory.

Ride Hailing: Airport ride bookings are down 10% year over year, but the completion rate has improved by 2% year over year. Moving forward, AirAsia MOVE is focusing more on demand generation and improving the driver app.

AirAsia Rewards and other businesses: Rewards net revenue grew by 45% YoY due to higher point issuance and improved point redemption rates. To grow, AirAsia MOVE focuses on onboarding more external partners to join the rewards programme.

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.