The Amex Trendex: Digital Payments Edition provides a comprehensive look at how digital payments are reshaping consumer behavior and merchant strategies. From mobile wallets to biometric payments, this report highlights the challenges and opportunities businesses face as they navigate this rapidly evolving landscape.

American Express

American ExpressThe Evolving Digital Payments Landscape: Insights from the Amex Trendex Report

The Amex Trendex: Digital Payments Edition provides a comprehensive look at how digital payments are reshaping consumer behavior and merchant strategies. From mobile wallets to biometric payments, this report highlights the challenges and opportunities businesses face as they navigate this rapidly evolving landscape.

Key Trends and Insights

1. The Growth of Digital Payments

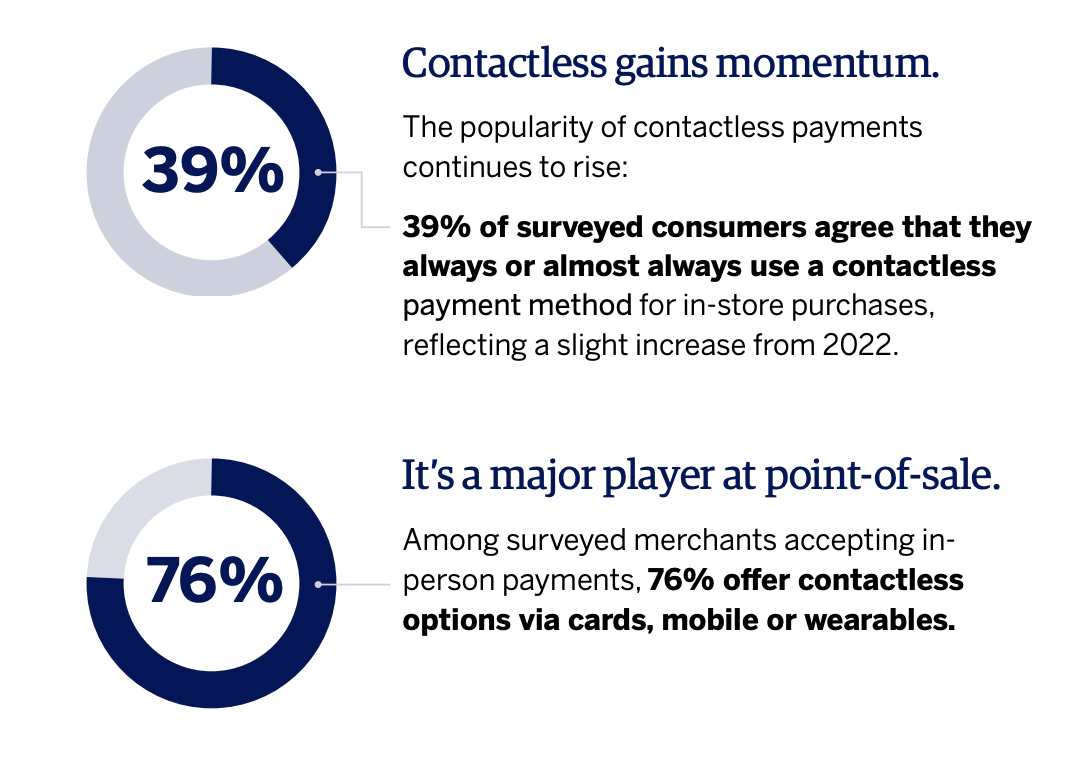

Digital payment methods now account for 32% of all sales transactions, with credit and debit cards still dominating at 51%. Contactless payments have gained momentum, with 76% of merchants offering these options, reflecting the growing demand for fast and secure transactions.

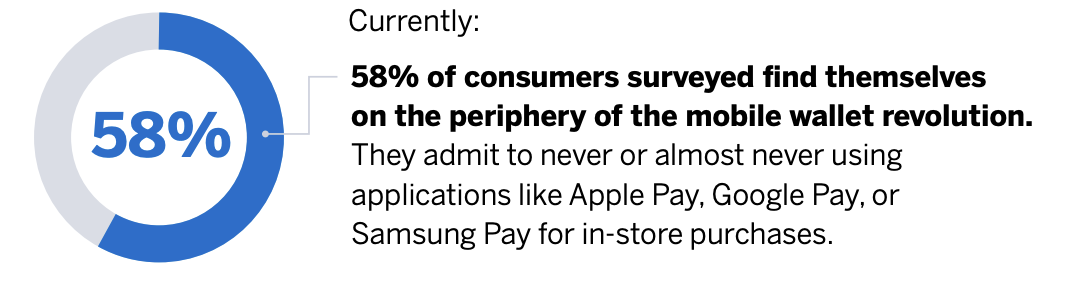

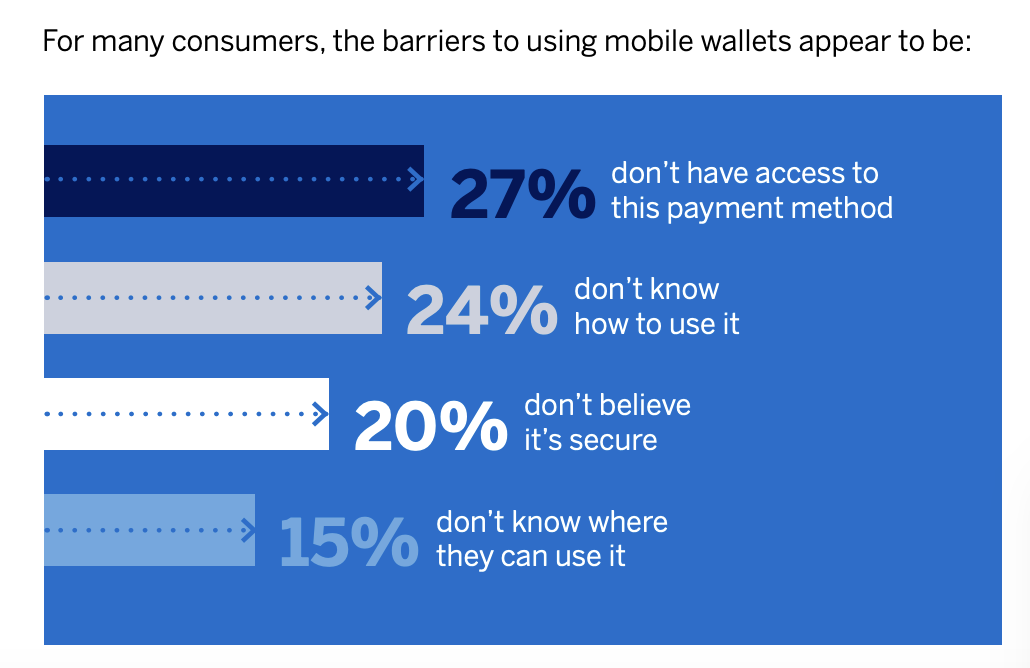

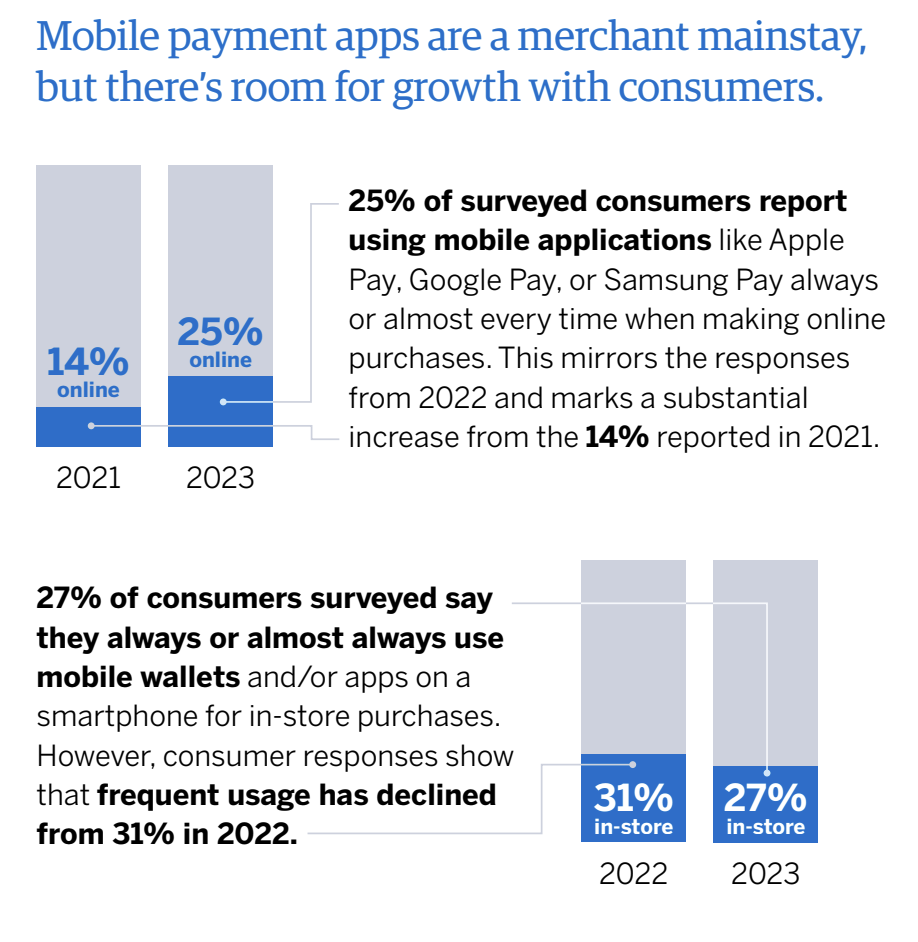

2. Mobile Wallets Adoption Lagging Among Consumers

Despite their convenience, 58% of consumers rarely use mobile wallets like Apple Pay or Google Pay. Barriers include lack of knowledge (24%), perceived insecurity (20%), and limited access (27%). Educating consumers on their benefits and security features could unlock this untapped potential.

3. Emerging Technologies Gaining Traction

Innovations like SoftPOS, wearables, and biometric payments are gaining interest. 88% of merchants are considering SoftPOS, which transforms smartphones into payment terminals, while 47% of consumers are open to biometric methods like fingerprint or facial recognition for transactions.

4. The Role of P2P Payments

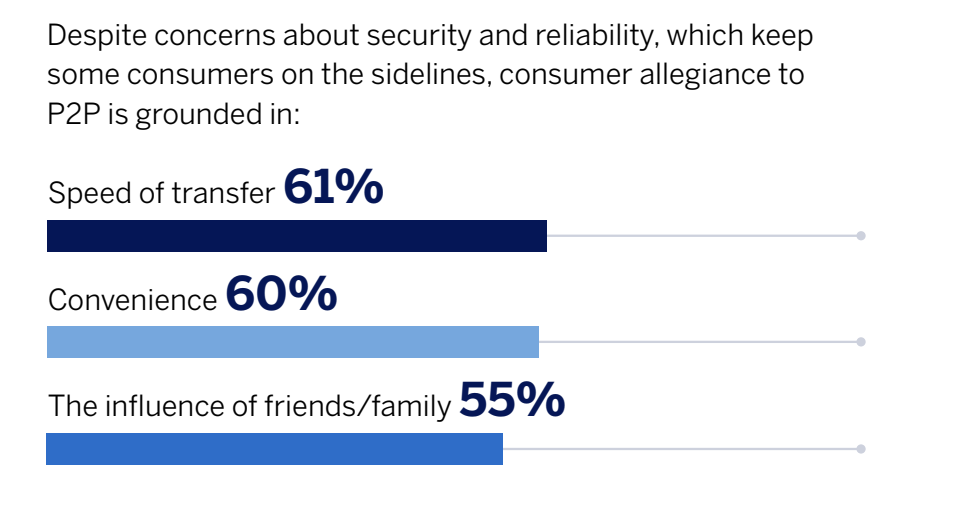

Peer-to-peer platforms like Venmo and Zelle remain popular, with 24% of consumers using them for online shopping. Their appeal lies in convenience (60%) and speed (61%), making them integral to the digital payment ecosystem.

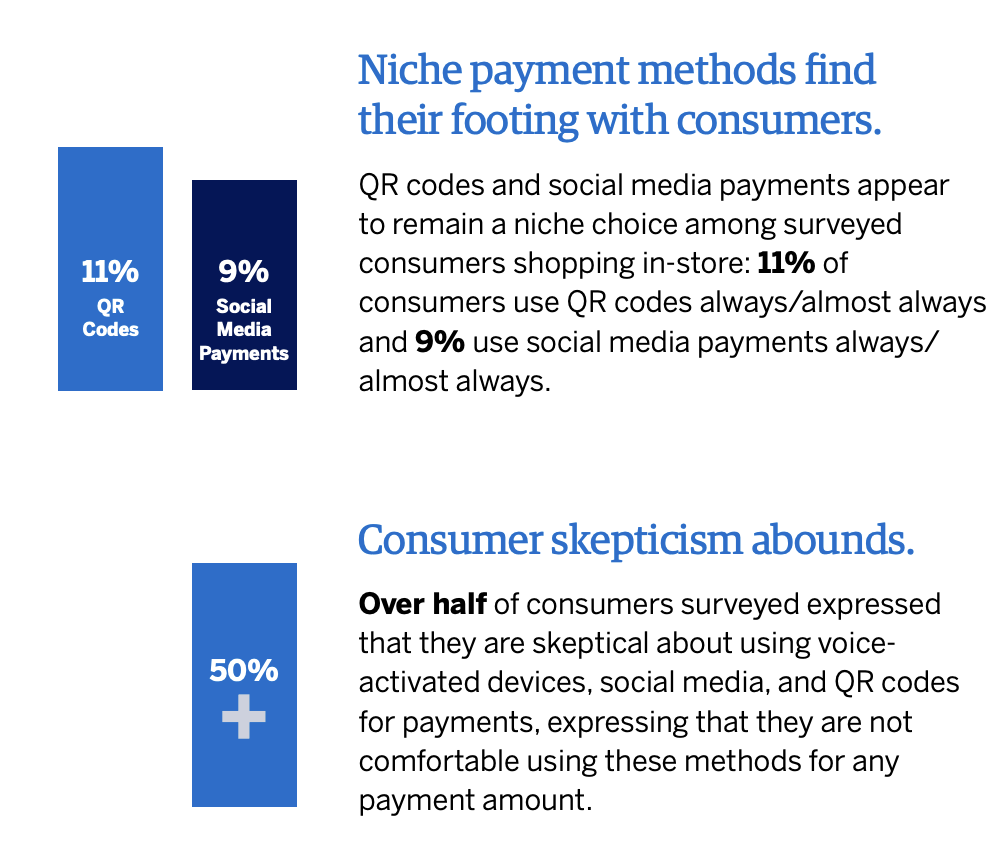

5. Consumer Preferences for Emerging Methods

Nearly half of consumers are willing to try emerging payment methods, such as connected cars (41%) and wearables (48%), particularly for use in retail, gas stations, and restaurants.

Overcoming Barriers to Adoption

While consumers increasingly seek seamless payment options, many remain cautious about emerging technologies. Concerns about data privacy (39%) and security (30%) highlight the need for businesses to educate and reassure users. Meanwhile, merchants face hurdles like integration costs and lack of demand, with 59% citing low customer interestas a barrier to adopting biometric payments.

Opportunities for Merchants

The report emphasizes the need for businesses to align with consumer preferences while leveraging emerging technologies:

- Flexibility Drives Engagement: Offering diverse payment methods can increase customer satisfaction and loyalty.

- Streamlined Solutions Boost Efficiency: Tools like SoftPOS reduce hardware costs and improve the checkout experience.

- Data Can Build Trust: Transparency in how biometric or mobile wallet data is collected and used can address consumer concerns.

The digital payment landscape is evolving rapidly, creating opportunities for businesses to innovate and enhance customer experiences. By addressing barriers, educating consumers, and adopting technologies like SoftPOS and biometric systems, businesses can position themselves for success in this increasingly digital world. As the report states, “Payments must be easy and safe,” emphasizing the importance of balancing innovation with consumer confidence.

Source: AMEX

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.