Atoa Payments wants to provide a cheaper alternative to Visa and Mastercard with lower processing fees and that is still easy for customers to use. The London-based fintech announced today that it has raised $2.2 million in pre-seed funding.

(Image Source)

GLOAtoa Payments wants to provide a cheaper alternative to Visa and Mastercard with lower processign fees and that is still easy for customers to use. The London-based fintech announced in November 2022 that it has raised $2.2 million in pre-seed funding.

What is Atoa?

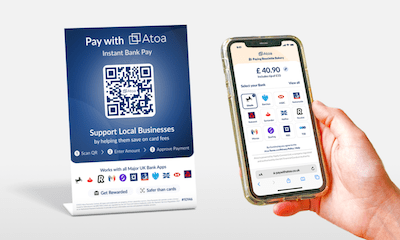

Atoa is a new way for UK merchants to accept payments in-store and online. Built on the UK Government’s Open Banking network, Atoa allows consumers to pay merchants via a fast and secure “instant bank transfer”. Atoa authenticates the customer’s identify and then instructs the customer’s bank to send funds instantly to the merchant’s bank account.

What are the main benefits over cards?

- Cost – Atoa is up-to 70% cheaper than Visa or Mastercard payments, this is possible as each Atoa payment is a direct bank transfer from the Consumer to the Merchant. Removing the middleman (e.g. Visa or Mastercard) enables us to substantially drive down the cost of accepting payments. Mastercard and Visa payment rails can cost small merchants and their customers net margins of 51%, with card machine fees of about 1.75%, Narayanan said. Atoa, on the other hand, charges a fixed percentage fee billable to merchant each month that is up to 70% lower than debit cards. It also does not have hardware rentals, service fees or PCI attestation of compliance charges.

- Speed – Atoa is significantly faster than card payments. When a merchant accepts card payments it takes 24-72 hours to receive the funds in his/her bank account. In comparison, Atoa settles funds to the Merchant’s Bank account instantly (typically under 10 seconds). This significantly improves business cashflow.

- Flexibility – Unlike card schemes, Atoa doesn’t make you sign contracts or pay sneaky charges (e.g. hardware fees, PCI compliance fees). Registration is easy and only takes a few minutes. Atoa allows you to accept payment anywhere (In-Store QR or remotely via SMS, email or smartphone QR code).

- Security – While card numbers can be easily misplaced or copied, Atoa uses Strong Customer Authentication to protect every transaction. Every Atoa transaction is protected using Face ID or Fingerprint Scan.

Atoa pricing

Atoa charges merchants a flat rate fee of 0.6% per transaction, this is up-to 70% lower than traditional debit and credit card payments. Unlike card processors, we don’t charge businesses for hardware, PCI compliance or any other nonsense. Just simple, transparent pricing where you only pay when you transact.

Atoa safety

Firstly, Atoa is safer than card payments you do everyday. Atoa authenticates each transaction using Face ID or Fingerprint Scan, then and only then is the Consumer’s Bank asked to transfer funds to the Merchant’s Bank. Atoa does not store any of the Consumer’s sensitive information and every transaction must pass the Consumer’s Bank fraud detection system.

Atoa operates under an Authorised Payment Initiation license from the UK Financial Conduct Authority provided to Yapily Connect Limited. This ensures that Atoa meets the highest standards of security and compliance.

How to sign up?

Registering with Atoa is quick and easy. You can sign up as a sole trader or company in under three minutes. Simply download the “Atoa Merchant” app, verify your details and connect your UK Bank Account to receive payments.

You’ll even get 14 days of free transactions to try out the service. After your 14 day trial, you’ll be billed once a month using BACS Direct Debit and pay a great value 0.6% per transaction.