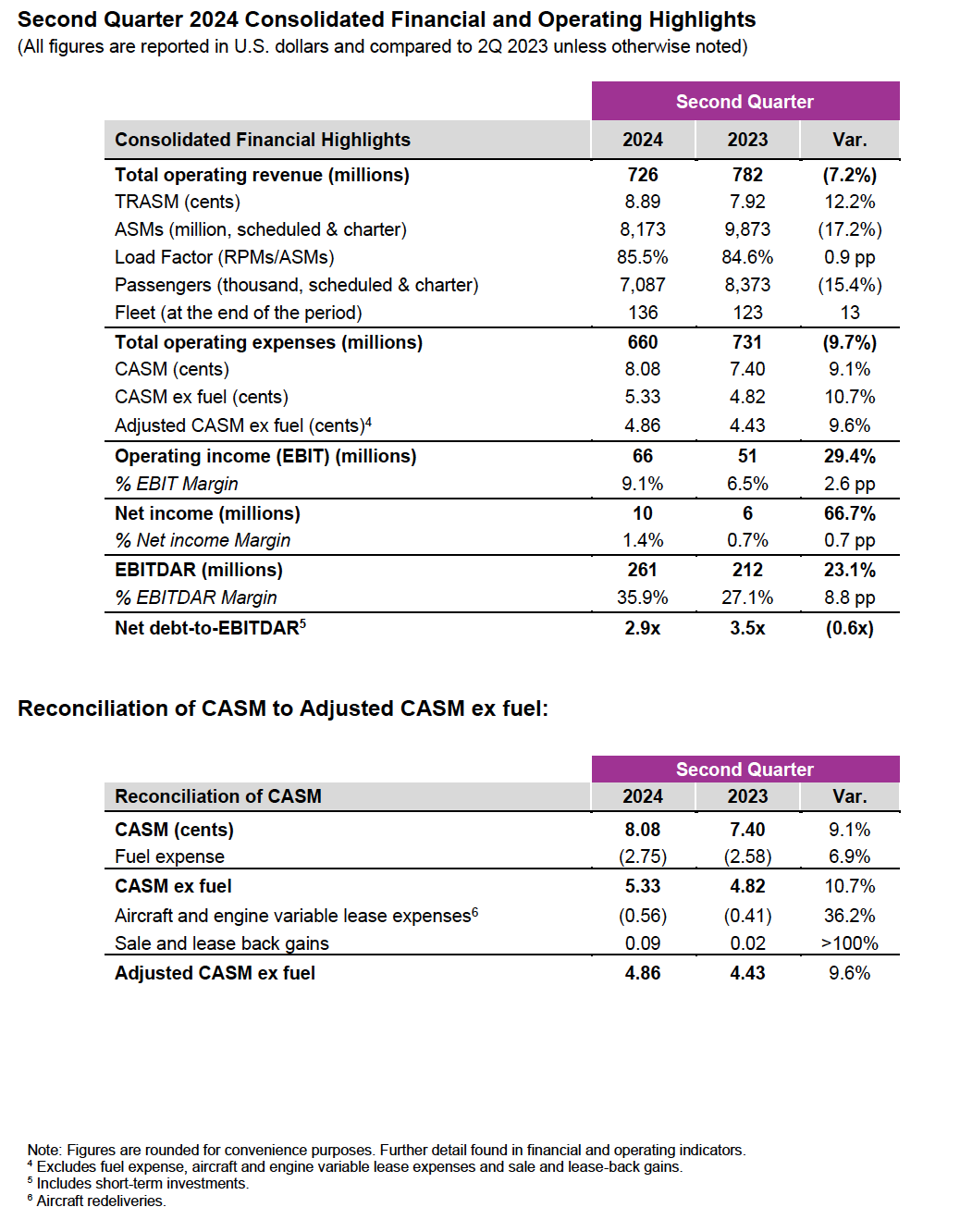

Net income of $10 million. Earnings per American Depositary Shares (ADS) of $9 cents. Total operating revenue of $726 million, a 7.2% decrease. Total revenue per available seat mile (TRASM) increased 12% to $8.89 cents. Available seat miles (ASMs) decreased by 17% to 8.2 billion.

(Image Source)

VolarisMexico City, Mexico, July 22, 2024 – Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (NYSE: VLRS and BMV: VOLAR) (“Volaris” or “the Company”), the ultra-low-cost carrier (ULCC) serving Mexico, the United States, Central, and South America, today reports its unaudited financial results for the second quarter of 20241.

Second Quarter 2024 Highlights

(All figures are reported in U.S. dollars and compared to 2Q 2023 unless otherwise noted)

Net income of $10 million. Earnings per American Depositary Shares (ADS) of $9 cents.

Total operating revenue of $726 million, a 7.2% decrease.

Total revenue per available seat mile (TRASM) increased 12% to $8.89 cents.

Available seat miles (ASMs) decreased by 17% to 8.2 billion.

Total operating expenses of $660 million, representing 91% of total operating revenue.

Total operating expenses per available seat mile (CASM) increased 9.1% to $8.08 cents.

Average economic fuel cost increased 6.1% to $2.86 per gallon.

CASM ex fuel increased 11% to $5.33 cents.

EBITDAR of $261 million, a 23% increase.

EBITDAR margin was 35.9%, an increase of 8.8 percentage points.

Total cash, cash equivalents, restricted cash, and short-term investments totaled $774 million, representing 24% of the last twelve months’ total operating revenue.

Net debt-to-LTM EBITDAR2 ratio decreased to 2.9x, compared to 3.1x in the previous quarter.

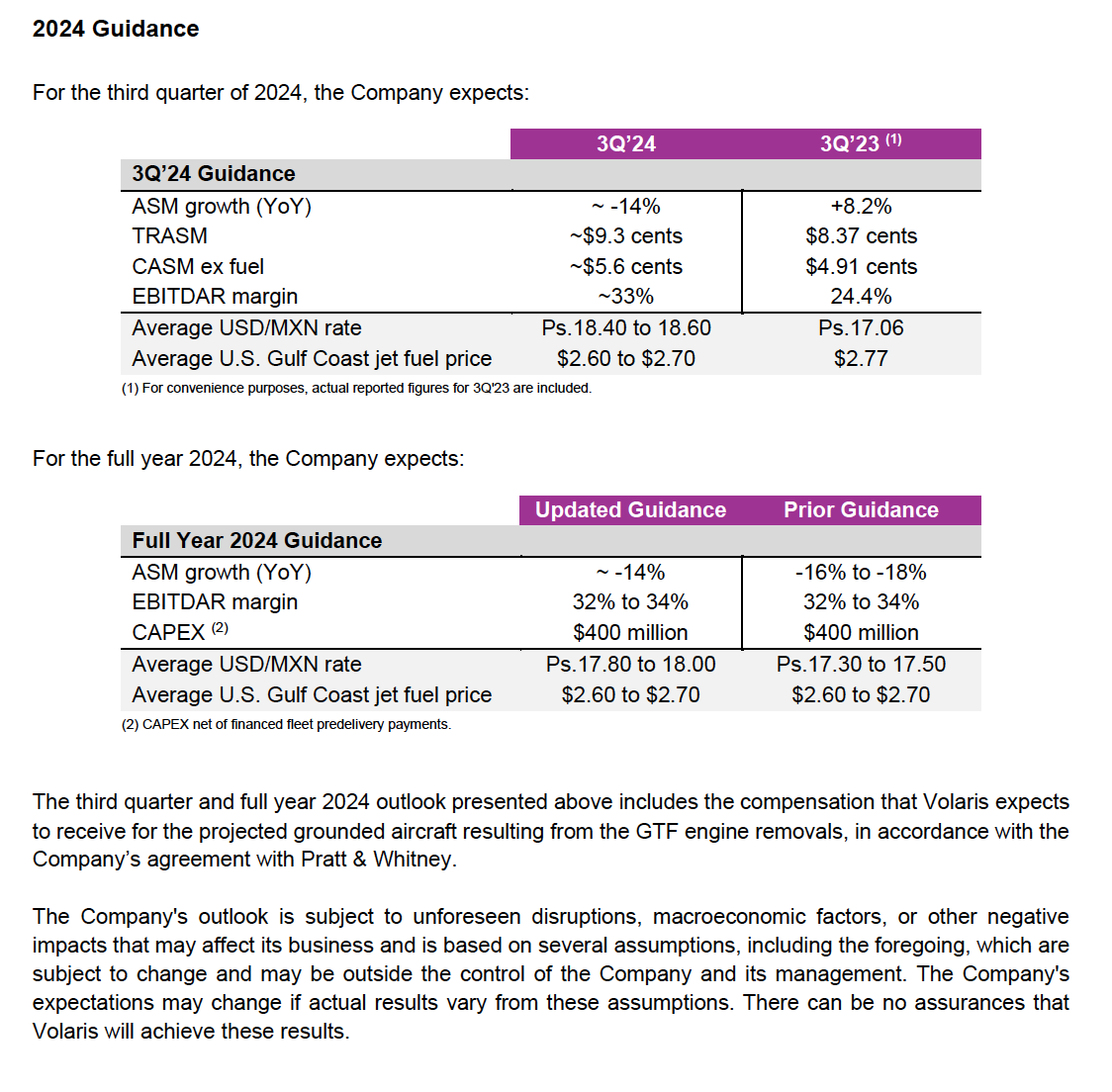

Enrique Beltranena, President & Chief Executive Officer, said: “Volaris continues to perform positively, achieving our highest absolute EBITDAR for a second quarter despite the fleet groundings due to accelerated engine inspections. Volaris’ unwavering focus on execution and efficient cost control has enabled us to deliver strong results. Our mitigation plan is on track with favorable outcomes, and we have largely achieved our goals since the inspections began. In fact, we are improving our full-year ASM guidance to -14%3. We currently have a well-balanced market mix, with an increased presence in the cross-border market that has strengthened our TRASM, and our booking curves indicate ongoing robust performance for the summer high season.

With recent updates from Pratt & Whitney, we are cautiously optimistic about this evolving situation, but we recognize that the engine’s time on wing remains a challenge. Looking ahead, as grounded aircraft gradually return to our productive fleet, we expect recent unit revenue levels to remain resilient and remain committed to prudent and rational growth, prioritizing profitability.”

(Image Source)

Second Quarter 2024

(All figures are reported in U.S. dollars and compared to 2Q 2023 unless otherwise noted)

Total operating revenue amounted to $726 million in the quarter, driven by strong domestic demand and an improvement in total operating revenue per passenger. This represents a 7.2% decrease, notwithstanding the 17% reduction in total capacity resulting from aircraft-on-ground (AOG) due to Pratt & Whitney’s accelerated engine inspections.

Total capacity, in terms of available seat miles (ASMs), was 8.2 billion.

Booked passengers totaled 7.1 million, a 15% decrease. Mexican domestic and international booked passengers decreased 18% and 4.9%, respectively.

The load factor for the quarter reached 85.5%, representing an increase of 0.9 percentage points.

TRASM rose 12% to $8.89 cents, and total operating revenue per passenger stood at $102, representing a 9.8% increase.

The average base fare was $49, a 4.3% increase. The total ancillary revenue per passenger was $53, reflecting a 15% improvement. Ancillary revenue represented 52% of total operating revenue, up by 2.6 percentage points.

Total operating expenses were $660 million, representing 91% of total operating revenue.

CASM totaled $8.08 cents, a 9.1% increase when compared to the same period of 2023.

The average economic fuel cost rose 6.1% to $2.86 per gallon.

CASM ex fuel increased 11% to $5.33 cents, mainly due to the AOG due to Pratt and Whitney’s engine preventive accelerated inspections.

Comprehensive financing result represented an expense of $52 million, compared to a $43 million expense in the same period of the previous year.

Income tax expense was $4 million, compared to a $2 million expense registered in the second quarter of 2023.

Net income in the quarter was $10 million, with an earnings per ADS of $9 cents.

EBITDAR for the quarter was $261 million, a 23% improvement, primarily attributable to strong unit revenues and efficient cost control, partially offset by an increase in fuel prices. EBITDAR margin stood at 35.9%, up by 8.8 percentage points.

Balance Sheet, Liquidity, and Capital Allocation

For the quarter, net cash flow provided by operating activities was $304 million. Net cash flow used in investing and financing activities was $141 million and $149 million, respectively.

As of June 30, 2024, cash, cash equivalents, restricted cash, and short-term investments were $774 million, representing 24% of the last twelve months’ total operating revenue.

The financial debt amounted to $638 million, while total lease liabilities stood at $3,003 million, resulting in a net debt of $2,8677 million.

Net debt-to-LTM EBITDAR7 ratio stood at 2.9x, compared to 3.1x in the previous quarter and 3.5x in the same period of 2023.

The average exchange rate for the period was Ps.17.21 per U.S. dollar, a 2.9% appreciation. At the end of the second quarter, the exchange rate stood at Ps.18.38 per U.S. dollar.

(Image Source)

Source: Volaris

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.