Collinson publishes study diving into booking, spending, travelling and loyalty patterns of sports and music fans. Research was conducted among a sample of 8,537 travellers from 17 countries and territories.

Collinson

CollinsonCollinson relaeased “The Value of Sports and Music Tourism” report which examines the desires of global sports and music fans regarding their travel experiences, how they are willing to enhance their trips, and the amount they are spending.

Accoring to Collinson, fans are eager to discover those unique and unforgettable moments that transform a trip into a ‘once-in-a-lifetime’ experience, creating lasting memories that extend well beyond the event itself. The increase in such travel is driven by a combination of factors:

- Events: With more sports and music events, fans have more choice of destinations.

-

Exposure: The internationalisation of new and existing sports leagues through TV and streaming has encouraged fans to travel, while music fans are finding it may be more cost-effective to see an artist abroad.

-

Experience: After years of Covid-19 travel restrictions, live events are back and fans are wanting new, enhanced experiences.

Key Takeaways:

- 83% have travelled by plane for sports and 71% for music in the past three years or plan to do so in the coming 12 months.

-

Majority of fans travel domestically, almost half(46%) of sports and two in five (42%) music fans travel internationally. Of those who travel internationally, 84% have travelled to a new city or country for a sports or music event and of those, 31% said they have gone back – with a further 30% planning to return at some point in the future. Those who do travel internationally are more likely to be under the age of 24, a key demographic to watch for future opportunities as they continue to travel for sports and music events. In addition, over half (56%) travel for events more than once a year, with 22% attending three or more events annually.

-

As the biggest global sport, it is unsurprising that the majority of travelling sports fans are watching football (soccer) (69%). Indeed, this group demonstrates huge passion, attending both international (72%) and domestic (71%) matches, displaying a willingness to score home and away.

-

Basketball is the second most popular sport that people travel for (27%), followed by the Olympics, Formula 1 (both 26%) and tennis (21%). On the other stage, music events attracting fans the most include Rock in Rio, Coachella and Tomorrowland and the most popular artists are Taylor Swift, Travis Scott, Vasco Rossi and Ed Sheeran.

- 84% have travelled to a new city or country for a sports or music event; 31% said they have gone back; 30% plan to return in the future.

- The majority of music (78%) and sports (76%) fans like to arrive between one and three days before an event, while 80% of music fans and 79% of sports fans like to stay one to three days after an event.

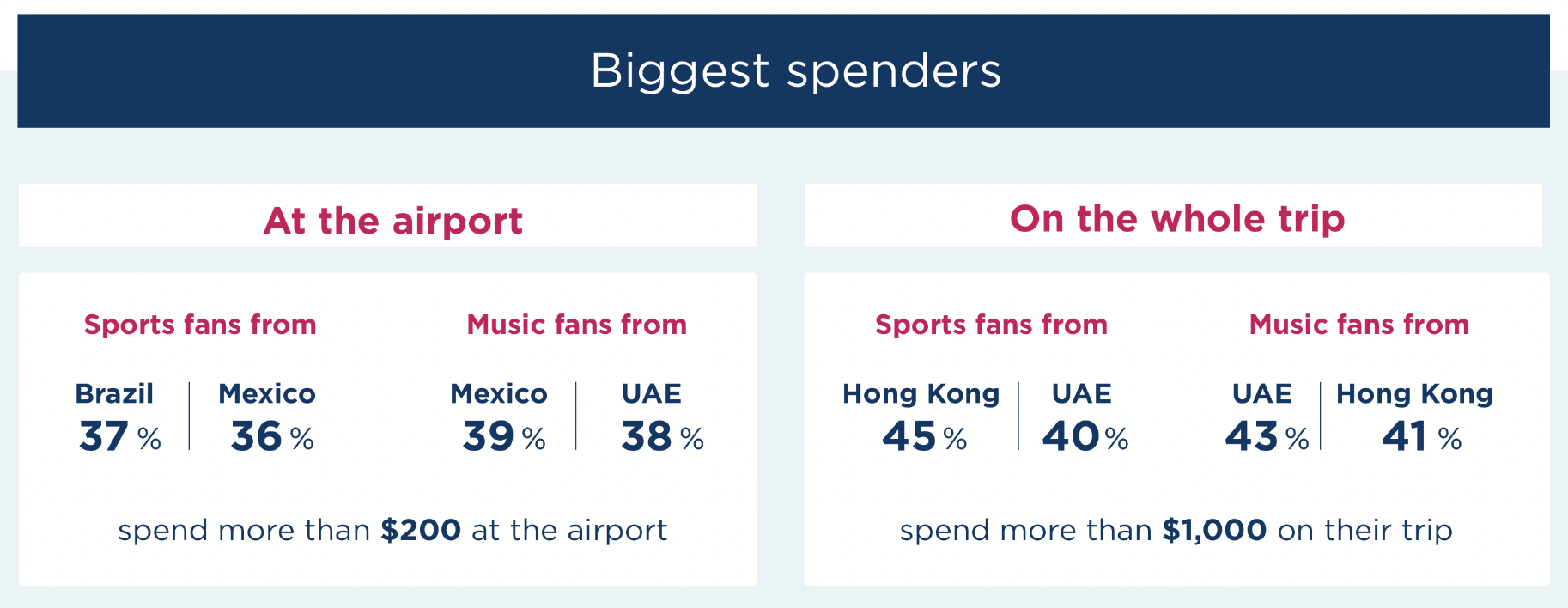

- At the airport: The typical spend for event travellers at airports is $100 (44%) but this varies considerably with those travelling for Formula 1 (32%), the Olympics (31%) and basketball (30%) prepared to spend $200 or more. As for those travelling for music, 25% are prepared to spend $200 or above. Sports fans aged between 25 and 34 spend the most at the airport. More than two-thirds (70%) of this age group will spend more than $50 compared to 64% of all travellers. Similarly, their peers travelling for music events are more generous in their spending with 49% parting with $50 or more.

- The whole trip: Sports fans are the biggest spenders. Over half (51%) of these travellers exceed $500 per trip, of which 29% spend more than $1,000, especially so for international visits (35%), while notably 17% of respondents in Asia spend more than $2,000. The 25-34 age group spends the most overall, with a third (33%) exceeding $1,000 for sports and 31% for music events.

- A 1/3 of 25-34 year olds spend >$1,000 per trip.

Image: Collinson

On Team Travelling:

- A third of fans (33%) travel to sports or music events with just their partners with travellers from Mexico the most likely to do so.

- More than a third travel with friends (38%), with the preference being in groups of fewer than five people (31%). Trips to music events with friends are more popular (40%) than those travelling for sports (37%).

- When looking at the split between music and sports trips among genders, it is men who travel more for sports events (56%) than for music events (51%), while women travel more for music events (49%) than for sports events (43%).

On Airport Experience:

- Almost half (47%) of fans have used airport experiences when travelling for an event, which includes visiting an airport lounge (29%), gaming lounges (16%), sleep pods (13%) and spa (12%).

- The uptake of airport lounges is higher among those spending more money on the trip overall. Interestingly, those travelling to basketball events (48%), Formula 1 (45%) and the Olympics (44%) are more likely to use lounges. In addition, 45% of music event spenders and 40% of sports event spenders exceeding $1,000 use lounges. However, airport lounges are still accessible for moderate spenders – 34% of those spending over $250 tend to visit a lounge when travelling to an event.

On Loyalty:

- Over half of event travellers (55%) participate in loyalty programmes. Most have joined loyalty programmes that offer discounts on flights (52%), tickets (43%), points/miles (41%), or accommodation (40%). Over a third (38%) of event travellers would choose a payment card that offered exclusive travel benefits such as an event package (flights, accommodation, transfers and tickets), travel insurance (38%) and airport lounge access (33%).

- Airport lounge access is a popular travel benefit through payment cards, particularly for travellers from India (43%), Hong Kong, UAE, Australia (all 41%), Singapore (40%), Germany (34%), UK (33%) and Brazil (32%).

On Using Travel Agents:

- Over half of travellers (54%) use travel agents when booking a package deal for an event, more so for sports fans (58%) than music fans (55%), with event travellers from Thailand (74%), India (69%) and Brazil (68%) most likely to use travel agents.

- While 46% haven’t booked a package with a travel agent, over 1 in 4 (29%) would consider it if available.

Notes: Collinson International has commissioned this research independently. The report is not endorsed by any party mentioned herein. When asked what cities travellers would visit, Sydney came out as the top destination (27%), followed by London (25%), Barcelona and Dubai (both 24%) and Paris and New York (both 23%). When asked what reasons fans visit airport lounges, 54% of music and 53% of sports fans said to relax and unwind, 50% of music and 49% of sports fans said to take advantage of food and drink options, and 48% of music and sports fans said to enjoy a calm space. Currency in USD.

Methodology: Research commissioned by Collinson International, owner and operator of Priority Pass, and independently conducted among a sample of 8,537 travellers from 17 countries and territories including: Australia (505), Brazil (502), Colombia (503), France (501), Germany (503), Hong Kong (501), India (502), Italy (504), Mexico (502), Peru (503), Saudi Arabia (501), Singapore (503), Spain (501), Thailand (503), UAE (501), UK (502) and USA (500). The survey was completed online in June 2024.

About Collinson International: Collinson International is a global leader in the provision of airport experiences, loyalty and customer engagement solutions and the owner and operator of Priority Pass, the original and market-leading airport experiences programme and, LoungeKey. Through our understanding of the needs, behaviours and spending habits of frequent travellers, we can create strategic customer engagement solutions that are customer-centric and data-driven, helping businesses boost engagement, build loyalty and drive additional value.

Access full report here.

Source: Collinson

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.