Motivation AI Company Persado Reveals 45% of Consumers Would Switch Banks For More Personalized Experiences.

GLO

GLOA new study reveals banks are not meeting the personalization expectations of U.S. consumers, with 45% of consumers surveyed saying they would consider switching banks for one that delivers more personalized digital experiences. Conducted by Researchscape and commissioned by Motivation Artificial Intelligence (AI) company Persado, the online survey of 1,061 U.S. adults ages 18 and older, with at least one bank account, was fielded August 16-20, 2024. The study also asked consumers whether it’s acceptable for banks to use AI to help understand their needs and preferences, with 75% saying “yes.”

The study findings are incorporated into a newly-published Persado report, The State of AI in Financial Services Marketing: Expectations, Uses, & Impact, which details the top AI use cases for creating personalized and engaging communications that build loyalty, along with several real-world success stories.

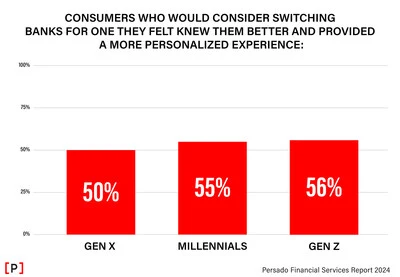

Unmet Expectations Span Generations

Overall, the study revealed consumers’ desire to be better known by their primary banks, as reflected in personalized marketing communications. In fact, 45% of respondents believe their primary bank knows them only “somewhat, hardly, or not at all.” The survey also found:

- Out-of-touch — 50% of all respondents feel bank communications are formal, impersonal, dated, and out-of-touch.

- Impersonal — More than half (54%) of all respondents said the written communications from their banks were “somewhat, hardly, or not at all” personalized to their needs and preferences. Of the Baby Boomer consumers surveyed, 72% agreed their bank’s written communications aren’t personalized enough, and of the Gen X consumers surveyed, 59% felt the same way.

- Irrelevant — 39% of all respondents think the written communications from their banks are “somewhat, hardly, or not at all” relevant. Of the Baby Boomers surveyed, 55% concurred.

- Unengaging — Two-thirds of all respondents (66%) believe the written communications from their primary bank are “somewhat, hardly or not at all” emotionally engaging; and 85% of Baby Boomers, 73% of Gen X, 60% of millennials, and 46% of Gen Z consumers agree.

- Untrusted — When asked how often the content used in communications positively influenced their trust in the banks, 45% of consumers said “sometimes, rarely, or never.”

“If financial institutions want to be trusted and favored by their customers, there’s clearly much catching up to do. AI has paved the way for banks and card issuers to create highly relevant, engaging, and compliant content. There is little reason for banks to drag their feet on using AI to personalize communications,” said Assaf Baciu, President and Co-founder, Persado.

Emotion-Informed Personalization Drives Results

Today, 8 of the 10 largest U.S. banks already use Persado Motivation AI’s specialized knowledge base to understand customer intent and then create emotion-informed copy that is proven to increase engagement and unlock new growth. The platform has driven more than $2.5 billion in additional incremental revenue in the past five years for large financial services organizations collectively, including brands such as Ally Bank, LendingClub, and Chase.

Persado Motivation AI is a proven enterprise marketing solution comprising machine learning, large language model (LLM), and application layers, enabling marketers to generate and optimize content across platforms. Grounded in a deep knowledge base of marketing communications performance data, the platform outperforms content created by humans alone, or generalized LLMs, 96% of the time.

“Our customers apply Motivation AI to drive better experiences and growth across journeys, from opening new accounts to growing deposits, cross-selling, customer engagement, and retention. Financial services also gain peace of mind with the platform’s governance frameworks that ensure ethical, transparent, and compliant AI usage,” added Baciu.

About Persado

The Persado Motivation AI platform uses advanced machine learning, natural language processing, and deep learning transformer models to understand copy intent and create messages that motivate consumer action. Unlike large language models (LLMs), which learn from the wide internet, Persado’s AI is trained on a specialized dataset of real interaction and transaction data from 1.2 billion consumers, which measures and refine language, emotional response, and engagement—enabling enterprise marketers to drive significant business value. Eight of the 10 largest U.S. banks, 6 of the 7 top credit card issuers, and myriad iconic brands, including Ally Bank, Chase, Kate Spade, Marks & Spencer, and Verizon, trust Persado to engage customers across their journey, from acquisition to loyalty.

SOURCE Persado Inc.

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.