The State of Mobile 2025 report highlights AI integration, rising consumer spending, and shifting engagement trends across industries, with gaming, crypto, and video streaming experiencing strong growth, while social media and retail continue evolving through personalization and global competition. Additionally, mobile-first experiences are deepening, with increased time spent on apps, hybrid digital-physical retail strategies, and AI-powered automation driving the next wave of innovation.

GLO

GLOThe State of Mobile 2025 report by Sensor Tower provides a comprehensive analysis of the evolving mobile landscape, highlighting the biggest trends, revenue shifts, and behavioral changes across key app categories. Here are the most critical takeaways, statistics, and findings from each chapter.

1. Macro Mobile Trends

Key Insights:

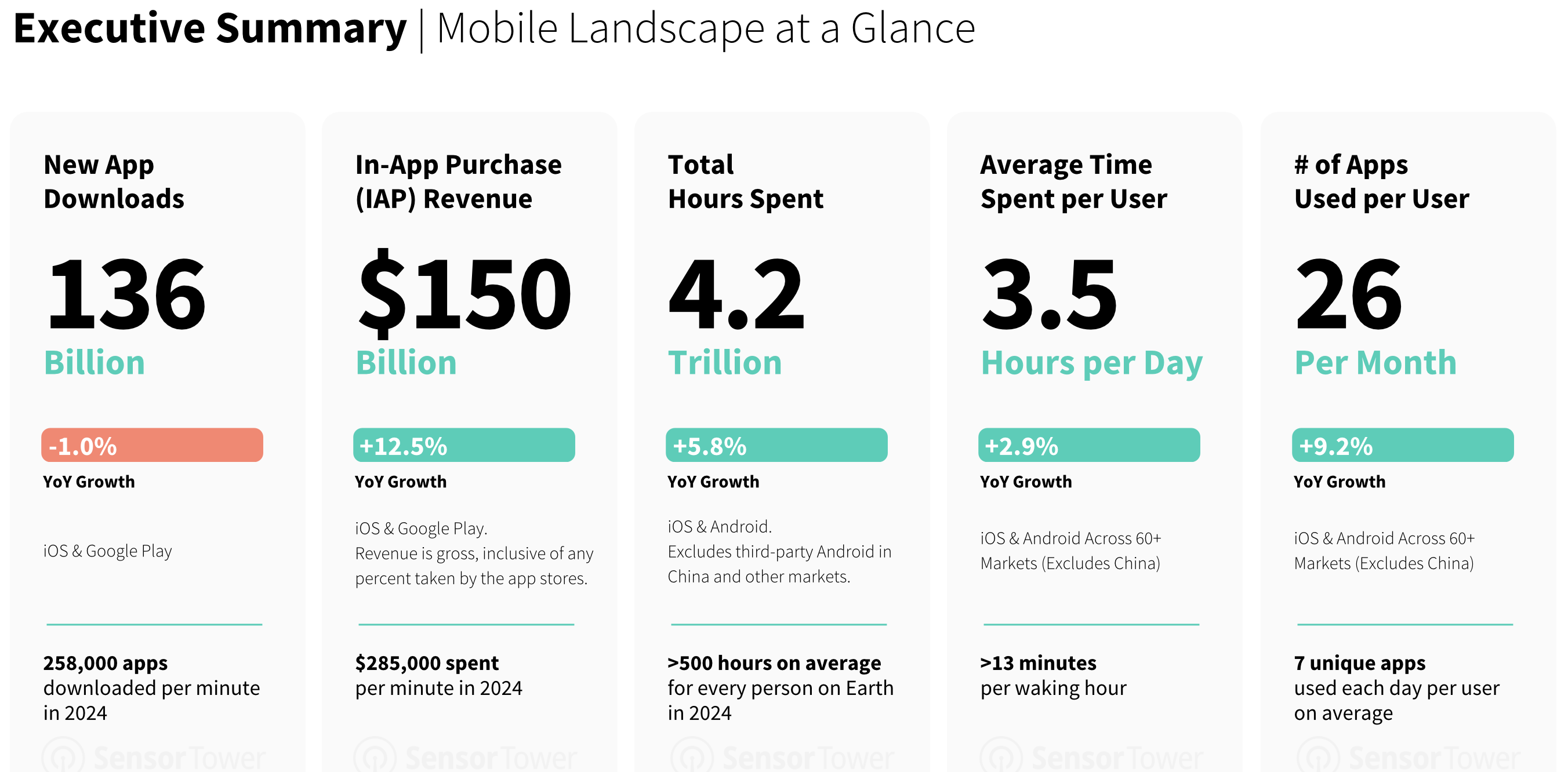

- Global App Downloads Declined: In 2024, 136 billion apps were downloaded across iOS and Google Play, reflecting a -1.0% YoY decline.

- Mobile Revenue Growth Accelerates: Despite the dip in downloads, in-app purchase (IAP) revenue surged to $150 billion, marking a +12.5% YoY increase.

- Time Spent on Mobile Reaches New Heights: Users spent 4.2 trillion hours on mobile in 2024, up +5.8% YoY.

- Daily Mobile Usage Increases: The average user spent 3.5 hours per day on mobile, equating to over 13 minutes per waking hour (+2.9% YoY).

- Diversity in App Usage: On average, users engaged with 26 different apps per month, an increase of 9.2% YoY.

2. AI on Mobile

Key Insights:

- AI Integration is Everywhere: AI-driven applications surged across verticals, from productivity and finance to entertainment and healthcare.

- AI-powered apps led app store revenue growth, with several new players entering the space.

- Chatbot adoption skyrocketed, with millions of users engaging daily in AI-powered text and voice interactions.

3. Gaming Industry Rebound

Key Insights:

- Gaming Revenue Grows After a Slump: In-app purchases in gaming rebounded with a +4% YoY increase, led by Strategy, Puzzle, and Action games.

- More Monetization in Gaming: Mobile game developers optimized revenue with new monetization strategies, including battle passes, subscriptions, and in-game events.

- Hypercasual Gaming Faces Challenges: While still popular, hypercasual game downloads declined as engagement shifted to deeper, more immersive experiences.

4. Finance and Crypto Apps Resurgence

Key Insights:

- Crypto is Booming Again: Fueled by macroeconomic recovery and Bitcoin’s price increase, crypto apps saw a major resurgence.

- Investment and Trading Apps Gain Users: Mobile-first investment platforms attracted millions of users, particularly in emerging markets.

- Fintech Innovation Continues: Digital banking, BNPL (Buy Now, Pay Later), and AI-powered financial management apps gained momentum.

5. Retail and E-Commerce

Key Insights:

- Retail Sees Global Competition: Chinese-backed giants Temu and SHEIN aggressively expanded their presence worldwide.

- Mobile Shopping Becomes More Personalized: AI-driven recommendations boosted engagement and conversions.

- Retailers Focus on Hybrid Models: Many top-performing brands connected digital experiences with in-store shopping to counter digital fatigue.

6. Video Streaming

Key Insights:

- Streaming Revenue Surges: In-app subscriptions for video platforms continued to grow.

- Competition Intensifies: Platforms like Netflix, Disney+, and Amazon Prime Video introduced more ad-supported plans.

- Short-Form Content Gains More Traction: Apps like YouTube Shorts and TikTok further disrupted traditional streaming behaviors.

7. Social Media Trends

Key Insights:

- New Social Platforms Gaining Traction: Bluesky and Threads emerged as viable alternatives to legacy platforms.

- Short-Form Video Dominates Engagement: TikTok and Instagram Reels led in user engagement, challenging traditional feed-based apps.

- AI-Generated Content and Avatars: More platforms integrated AI-powered features like AI profile pictures, chatbots, and auto-generated captions.

8. Food & Drink Apps

Key Insights:

- Mobile Ordering and Delivery Keep Growing: Consumers continued shifting to mobile-first food delivery, with strong growth in grocery delivery apps.

- Loyalty Programs Drive Engagement: Starbucks, McDonald’s, and other major brands enhanced mobile rewards programs.

- Subscription-Based Food Services Surge: Meal kit subscriptions and digital ordering platforms expanded.

9. Travel & Hospitality

Key Insights:

- Travel Bookings Hit New Highs: Travel apps saw a significant rebound as global travel demand surged.

- AI-Powered Trip Planning: More platforms incorporated AI-driven itinerary builders and personalized recommendations.

- Super Apps Dominate in Asia: Regional super apps like Grab and Gojek integrated travel, dining, and shopping into a single ecosystem.

10. Health & Fitness

Key Insights:

- Wearable Tech Integration Rises: More fitness apps synced with wearable devices for real-time health tracking.

- Mental Health Apps Gain Adoption: Meditation and wellness apps like Calm and Headspace grew in popularity.

- AI-Powered Fitness Coaching: AI-driven personal training apps saw increased user engagement.

11. Sports & Betting Apps

Key Insights:

- Live Sports Streaming Apps Grow: Sports leagues launched dedicated streaming platforms.

- Betting Apps See Increased User Engagement: Legalized online sports betting markets drove revenue growth.

- Fantasy Sports App Expansion: Daily fantasy sports apps attracted millions of new users.

12. Top Apps & Games of 2024

Key Insights:

- Most Downloaded Apps: TikTok, Temu, Instagram, and WhatsApp topped global app downloads.

- Top-Grossing Apps: Subscription-based apps like YouTube Premium, Tinder, and Disney+ led in revenue.

- Best-Selling Mobile Games: Roblox, Honor of Kings, and Candy Crush Saga remained dominant.

Final Thoughts: Mobile’s Future in 2025

The State of Mobile 2025 report paints a picture of an increasingly AI-driven, immersive, and competitive mobile ecosystem. With consumer spending at an all-time high and new monetization models emerging across industries, brands and developers must continue innovating to capture user attention in an ever-evolving mobile-first world.

Source: State of Mobile

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.