Galileo integrates another new solution, powered by Atomic, to help clients become the first choice for everyday spend and grow recurring revenue. (Image: Galileo )

GLO

GLOGalileo Financial Technologies, SoFi Technologies, Inc.’s Technology Platform (NASDAQ: SOFI), has launched Galileo Payment Method Switch, powered by Atomic. This product enables banks, fintechs and brands to make it easier for people to update their default payment method—including debit cards, credit cards, and bank accounts—across leading merchants, subscription services, utility providers, and digital wallets like Venmo or PayPal, all in one place.

Clients can embed Galileo Payment Method Switch into their own apps, positioning their card or account as the most visible and convenient option for recurring bills and everyday payments.

Clients can embed Galileo Payment Method Switch into their apps, positioning their own issued card or account as the most visible and convenient option for recurring bills and everyday payments–helping them become their customers’ preferred choice as subscription-based and automatic payments continue to rise. Global recurring payment transactions are projected to exceed $15.4 trillion in 2027.

According to Atomic, people switch an average of three to five payments during their first visit, linking approximately $420 in recurring monthly spend. These usage patterns underscore growing demand for fast, easy ways to manage payments—especially when cards expire or accounts change.

Galileo Payment Method Switch lets people update their payment method in seconds. With a single integration–also compatible with Galileo Direct Deposit Switch–clients can speed up launch timelines and give people an easy way to update payment methods, directly from their app.

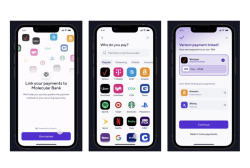

Visual example of Galileo Payment Method Switch embedded within a banking app. This experience can also be integrated into fintech or brand apps, enabling customers to easily update payment details for recurring bills—without leaving the app. Image: Galileo

Atomic provides the merchant connectivity to update information across billing systems, while Galileo manages the secure exchange of card and account details, helping clients simplify payment management for their customers, drive account primacy, and earn more interchange revenue.

“Galileo Payment Method Switch allows banks, fintechs and brands to help customers easily manage bill payments without leaving an app they already trust,” said Prashant Shah, Vice President, Product Management at Galileo. “This solution keeps people spending in a branded environment, creating new recurring revenue streams, which are proven to be stickier, more predictable and scalable. We’re pleased to expand our role as the one-stop shop for supporting modern payments.”

Benefits for Consumers

- Easy Updates in One Place: Change or update payment details–such as a new debit or credit card, or a different bank account– for thousands of popular merchants, subscriptions, and utility providers all from one banking, fintech, or brand app.

- More Control and Flexibility: Choose which card or account to use for each bill, giving them more control over how they pay.

- Fewer Payment Errors: Avoid missed payments or mistakes with fast, secure payment updates–no need to manually enter card or account details on multiple merchant websites.

Benefits for Banks, Fintechs and Brands

- Account Primacy and Increased Revenue: Boost customer stickiness by allowing them to set a default card or account for recurring bills and subscriptions, thereby increasing recurring payments and interchange revenue whenever a card is used.

- Faster Setup: One-time integration with simple steps that help customers get started quickly and stay connected.

- Stronger Loyalty: Making payments easy builds lasting customer relationships.

“We’re helping financial services providers stay top of wallet by delivering a more seamless experience for their customers,” said Jordan Wright, Co-founder and CEO of Atomic. “Our continued partnership with Galileo enables institutions to make it easier for people to update their payment methods—driving increased spend and deeper engagement.”

To learn more about Galileo Payment Method Switch, visit docs.galileo-ft.com/pro/docs/payment-method-switch.

About Galileo Financial Technologies

Galileo Financial Technologies, LLC and certain of its affiliates collectively comprise a financial technology company owned and operated independently by SoFi Technologies, Inc. (NASDAQ: SOFI) that enables fintechs, financial institutions, and emerging and established brands to build differentiated financial solutions that deliver exceptional, customer-centric experiences. Through modern, open APIs, Galileo’s flexible, secure, scalable and fully integrated platform drives innovation across payments and financial services. Trusted by digital banking heavyweights, early-stage innovators and enterprise clients alike, Galileo supports issuing physical and virtual payment cards, mobile push provisioning, tailored and differentiated financial products and more, across industries and geographies.

About Atomic

Atomic is the market leader in growing account primacy and enabling financial connectivity that drives action. They are trusted by over 195 financial institutions and fintech firms, including 13 of the top 20 fintech firms and 8 of the top 10 financial institutions. Atomic serves as the essential bridge between consumer data and financial solutions by allowing unparalleled access to payroll, HRIS systems, and merchants, facilitating a range of financial services including direct deposit switching, income and employment verification, payment method updating, and subscription management. For more information, visit https://atomic.financial.

©2025 Galileo Financial Technologies, LLC. All rights reserved.

Galileo Financial Technologies, LLC is a technology company, not a bank. Galileo partners with many issuing banks to provide banking services in North and Latin America.

Source: Galileo

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.