In 2024, the five largest U.S. airlines generated $28 billion in loyalty revenue—averaging $35.48 per passenger—underscoring how co-branded credit cards and frequent flyer programs now rival ancillary fees as the industry’s most powerful profit engines.

GLO

GLOAirlines Set Ancillary Fee Records, Lean Into Loyalty and Customer Experience Shifts

IdeaWorks published 2025 Yearbook of Ancillary Revenue excerpt, with special emphasis on loyalty programs and customer experience (CX). Airlines worldwide are transforming their business models as ancillary revenues hit historic highs in 2024, reshaping the passenger journey, loyalty programs, and the definition of value in air travel.

Record-Breaking Revenues

-

Global ancillary revenue reached $148.4 billion in 2024, a new industry record and well above the 2019 benchmark of $109.5 billion.

-

Ancillary revenue per passenger grew 2.5% year over year, while traditional fare-based revenue dropped 3.8%.

-

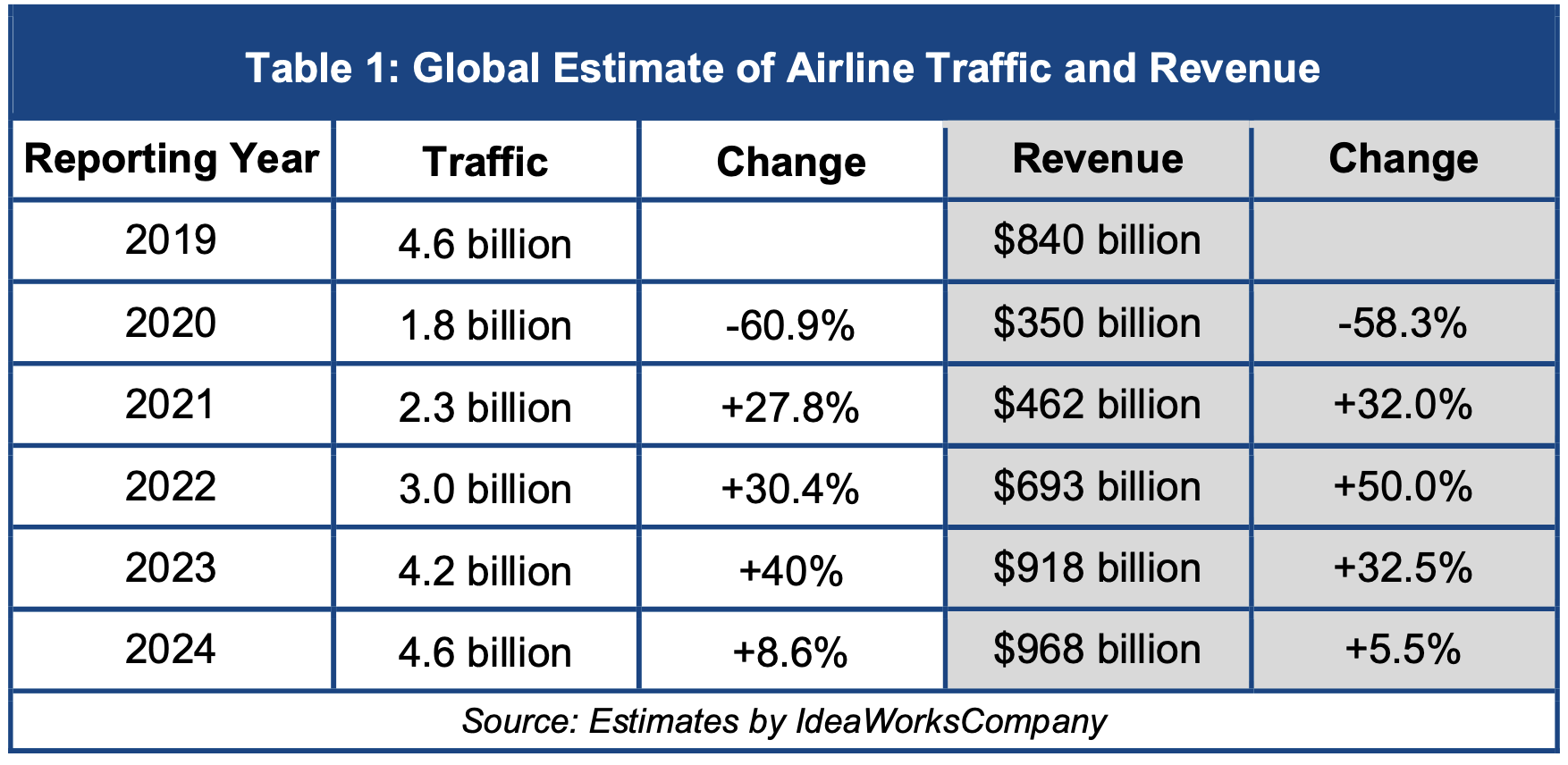

Overall airline revenues hit $968 billion in 2024, an 8.6% increase over 2023, with traffic returning to pre-pandemic levels.

LCCs Lead in Ancillary Share

-

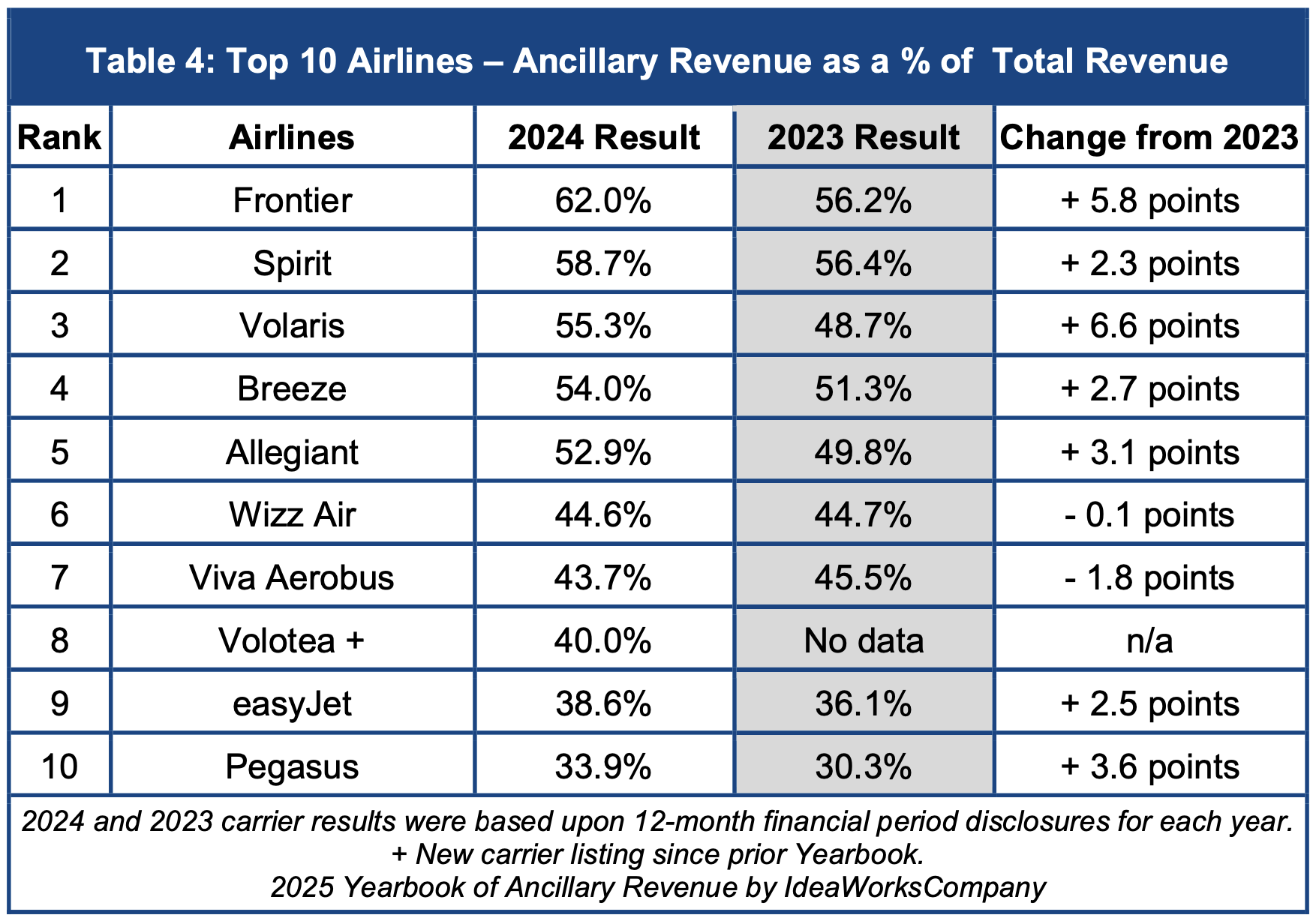

Low-cost carriers (LCCs) dominate the ancillary revenue landscape, driven by baggage policies, seat selection fees, and branded fare bundles.

-

Frontier Airlines crossed a milestone, deriving 62% of total revenue from ancillaries in 2024, the first airline to break the 60% barrier.

-

Other leaders included Spirit (58.7%), Volaris (55.3%), Breeze (54%), and Allegiant (52.9%), all now generating more from ancillaries than from fares.

-

Ancillary innovation extends to new services: easyJet expanded inflight retail, launched Costa Coffee onboard, and grew its Holidays unit to £1.137 billion in 2024.

The Loyalty Dividend

While LCCs thrive on à la carte retailing, loyalty programs remain the crown jewel of revenue generation for legacy carriers:

-

The five largest U.S. airlines—Alaska, American, Delta, Southwest, and United—generated $28 billion in loyalty revenue in 2024, averaging $35.48 per passenger.

-

Co-branded credit cards fuel much of this growth, with banks purchasing miles and points from airlines using merchant fee income.

-

In regions like the EU where merchant fees are capped, loyalty revenues are comparatively muted.

-

European examples highlight this model’s profitability: Air France-KLM’s Flying Blue program generated €811 million in revenue at a 24.7% margin, with 52% of passenger revenues tied to members.

Customer Experience: A Balancing Act

Ancillary growth comes with CX trade-offs:

-

Basic Economy Expansion: Once confined to LCCs, basic economy is now embraced by network carriers. It forces customers into à la carte upgrades, but risks eroding brand loyalty by mimicking LCC strategies.

-

Southwest’s Strategic Pivot: Long resistant to fees, Southwest announced plans to introduce checked bag feesand assigned seating beginning in 2026, moving closer to a hybrid model with two cabin tiers (premium and preferred seating).

-

Premium Experiments: Frontier is adding a Bizfare bundle and even a first-class cabin, showing that LCCs are moving into the premium CX space.

Implications for Loyalty and CX

-

For LCCs, loyalty remains secondary; their strength is in maximizing ancillary “retail” opportunities at every step of the journey.

-

For legacy carriers, loyalty programs are not only defensive tools but profit engines—often more valuable than ticket sales. Maintaining a balance between ancillary monetization and preserving loyalty-driven trust is critical.

-

For passengers, the result is a highly fragmented experience: they can pay less for a stripped-down journey or buy back comfort, flexibility, and perks piecemeal.

Outlook

The Yearbook of Ancillary Revenue signals an industry-wide metamorphosis. Airlines are no longer simply transportation providers—they are retail platforms with loyalty ecosystems attached. The winners will be those who can extract ancillary revenue without undermining customer trust, while still offering loyalty programs compelling enough to keep passengers engaged.

Source: IdeaWorks Company

Disclaimer: Press release

© Press Release 2025

Send us your press releases to news@globalloyalty.org

Press releases originate from external third-party providers. This website does not have responsibility or control over its content, which is presented as is, without any alterations. Neither this website nor its affiliates guarantee the accuracy of the views or opinions expressed in the press release.

The press release is intended solely for informational purposes and does not offer tax, legal, or investment advice, nor does it express any opinion regarding the suitability, value, or profitability of specific securities, portfolios, or investment strategies. Neither this website nor its affiliates are liable for any errors or inaccuracies in the content, nor for any actions taken based on it. By using the information provided in this article, you agree to do so at your own risk.

To the maximum extent permitted by applicable law, this website, its parent company, subsidiaries, affiliates, shareholders, directors, officers, employees, agents, advertisers, content providers, and licensors shall not be liable to you for any direct, indirect, consequential, special, incidental, punitive, or exemplary damages, including but not limited to lost profits, savings, and revenues, whether in negligence, tort, contract, or any other theory of liability, even if the possibility of such damages was known or foreseeable.

The images used in press releases and articles provided by 3rd party sources belong to the respective source provider and are used for illustrative purposes in accordance with the original press releases and publications.

Disclaimer: Content

While we strive to maintain accurate and up-to-date content, Global Loyalty Organisation Ltd. makes no representations or warranties of any kind, express or implied, about the correctness accuracy, completeness, adequacy, or reliability of the information or the results derived from its use, not that the content will meet your requirements or expectations. The content is provided “as is” and “as available”. You agree that your use of the content is at your own risk. Global Loyalty Organisation Ltd. disclaims all warranties related to the content, including implied warranties of merchantability, fitness for a particular purpose, non-infringement, and title, and is not liable for a particular purpose, non-infringement, and title, and is not liable for any interruptions. Some jurisdictions do not allow the exclusion of certain warranties, so these jurisdictions may not apply to you. Global Loyalty Organisation Ltd. Reserves the right to modify, interrupt, or discontinue the content without notice and is not liable for doing so.

Global Loyalty Organisation Ltd. shall not be liable for any damages, including special, indirect, consequential, or incidental damages, or damages for lost profits, revenue, or use, arising out of or related to the content, whether in contract, negligence, tort, statute, equity, law, or otherwise, even if advised of such damages. Some jurisdictions do not allow limitations on liability for incidental or consequential damages, so this limitation may not apply to you. These disclaimers and limitations apply to Global Loyalty Organisation Ltd. and its parent, affiliates, related companies, contractors, sponsors, and their respective directors, officers, members, employees, agents, content providers, licensors, and advisors.

The content and its compilation, created by Global Loyalty Organisation Ltd, are the property of Global Loyalty Organisation Ltd. and cannot be reproduced without prior written permission.